Preview of the Week Ahead

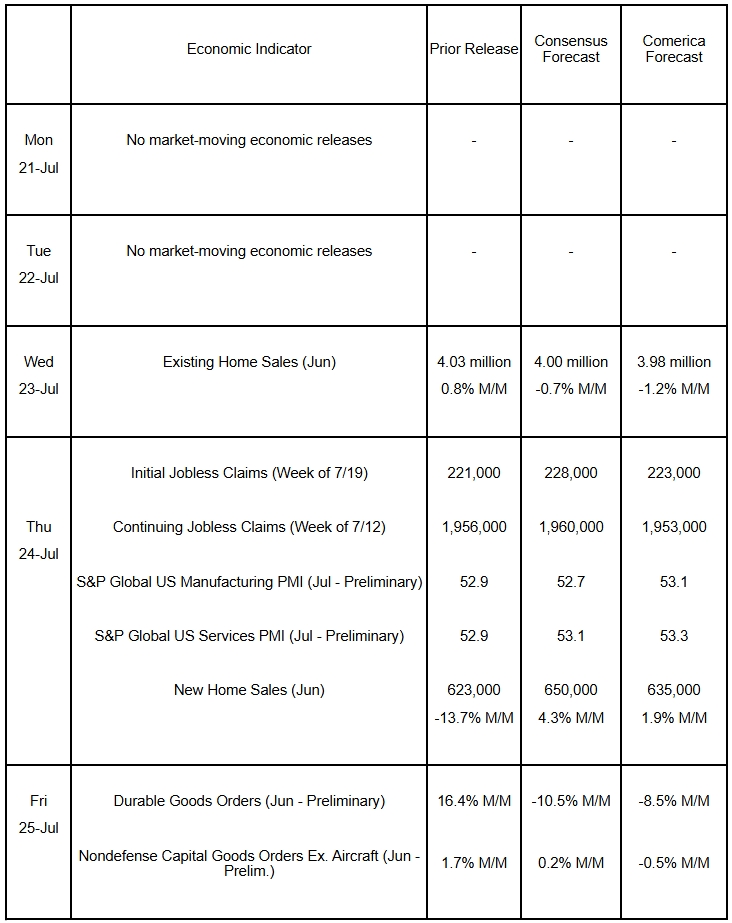

New home sales likely rebounded slightly in June from depressed levels in May, while existing home sales likely fell. The housing market is in a funk, held back by high mortgage rates, bad affordability, and rising homeowners’ insurance premiums. Home listings are above late 2010s levels in the Sunbelt metros that boomed post-pandemic, but still below them in slower-growing metros on the Pacific Coast, in the Midwest, and in the Northeast. Strong growth of housing supply in the Sunbelt is translating into modest house price declines, although prices are still much higher than they were five or ten years ago.

The manufacturing and services purchasing managers indexes (PMIs) published by S&P Global likely improved modestly in the July flash readings as businesses anticipate a boost to sales in 2026 from the tax cut. The surveys will likely show input price inflation continues to run hotter than in 2024 or 2023. Durable goods orders likely pulled back in June after a surge in May fueled by higher aircraft orders.

The Week in Review

Industrial production and retail sales were stronger than expected in June. Industrial production rose 0.3%, above the 0.1% consensus forecast, mostly due to a jump in utilities output. Manufacturing production edged up 0.1%. May was revised up. Retail and food services sales rose 0.6% and beat the 0.3% consensus, but didn’t fully reverse their 0.9% decline in May. Core retail sales excluding motor vehicles and parts, gasoline stations, and food services rose 0.5%, above the 0.3% consensus forecast and following a 0.2% decline in May. Control retail sales, a subset of core sales which go into the calculation of consumer spending in nominal GDP, rose 0.5% after a 0.2% increase in May.

Housing starts rebounded by 4.6% in June to an annualized rate of 1.321 million after a nearly 10% slump in the prior month and were also above the consensus forecast. Building permits also rose, up a modest 0.2%, to an annualized rate of 1.397 million, following a 2.0% decline in May. On the back of the passage of the OBBBA, homebuilder confidence for future sales rose slightly, nudging the NAHB / Wells Fargo Housing Market Index up one point to 33 in July. 38% of homebuilders reported cutting prices to boost sales, a record high since surveying this figure began in 2022.

President Trump reportedly discussed firing Fed Chair Jay Powell with members of Congress last week, causing a short-lived stock market selloff before the President denied that he was considering firing him. The President is pressuring Powell to reduce interest rates, and has also criticized him for the cost of the Fed’s renovation. Powell’s term as Fed Chair ends May 15, 2026, and his term as a member of the Federal Reserve Board continues until January 31, 2028.

The Fed’s Beige Book reported “economic activity increased slightly” in the latest survey period through early July. Employment rose “very slightly,” and inflation was “moderate” or “modest” in different regions. The Fed’s summary of its survey of contacts across the economy mentions tariff/tariffs 75 times, uncertain/uncertainty 63 times, pessimism/pessimistic 11 times, and optimism/optimistic six times.

For a PDF version of this publication, click here: Comerica Economic Weekly, July 21, 2025(PDF, 131 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.