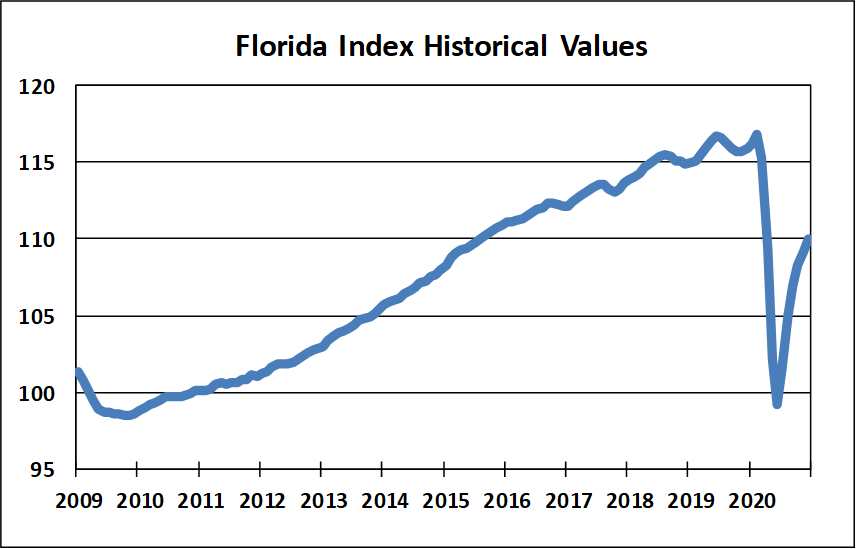

Comerica Bank’s Florida Economic Activity Index increased in December to a level of 110.0. December’s index reading was 10.9 percent above the recent index low of 99.2 set in June 2020. The index averaged 108.3 in 2020, 7.6 points below the average for all of 2019. November’s index reading was revised to 109.2.

Our Florida Economic Activity Index moved higher in December, improving for the sixth consecutive month. The index components were mostly positive in December. Eight of the nine components rose for the month including nonfarm employment, unemployment insurance claims (inverted), housing starts, house prices, industrial electricity sales, state total trade, state sales tax revenues and total enplanements. Hotel occupancy was the sole negative component in December. The state is experiencing a bifurcated recovery across the major sectors of the economy. Manufacturing is being supported by low borrowing costs and a rise in demand due to the reopening of domestic and foreign economies. Housing, particularly the single-family space, is benefitting from low mortgage rates and the shift in demand from urban core to the suburbs as well as a continued influx of new residents into the state. However, services are lagging the recovery, specifically in the leisure and hospitality sectors. Even while travel into the state picked up at year end, the state still faced a historically weak winter tourism season in late 2020 into early 2021. Florida is likely to see improving trends in travel-related sectors this year, yet we will not see a return to pre-pandemic levels soon. An effective vaccination program nationwide this summer would be a major positive. However, a labor recession in the U.S. will weigh on domestic demand for travel, entertainment and hospitality.