A combination of improved economic data helped to improve investor sentiment as Comerica Bank celebrated its 175th anniversary last week.

The S&P 500® punctuated its best one-week performance of the year with Comerica CEO Curt Farmer ringing the closing bell at the NYSE on Friday.

Executive Summary

- The Index has now fully recovered from its early-August losses, which were triggered by a weak jobs report that sparked growth concerns and an unwinding of the yen carry trade, sending both equity prices and bond yields tumbling.

- A series of positive economic reports have reassured investors that the Federal Reserve will be able to cut rates before the economy tips into a recession. Last week’s economic data sent contained two important messages: inflation is decelerating sufficiently enough for a cut in September and the economy is doing well enough that 50 basis point (jumbo) cuts are probably not necessary.

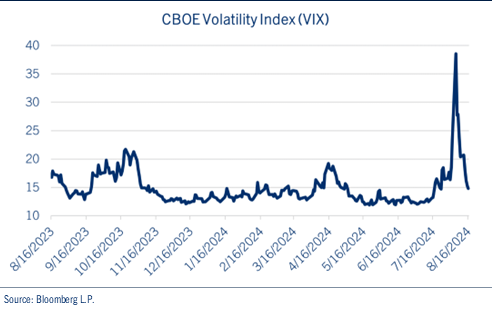

- The CBOE Volatility Index (VIX), often referred to as the "fear gauge," has made a dramatic round-trip in just two weeks. This rapid decline in the VIX suggests that the market's earlier fears were overblown, and that investor confidence has returned to the equity markets.

Despite the recent volatility, U.S. real GDP growth remains favorable, interest rates are heading lower and corporate profits are firm. We believe these three trends will help market sentiment should any further bouts of volatility materialize in the coming months.

Inflation

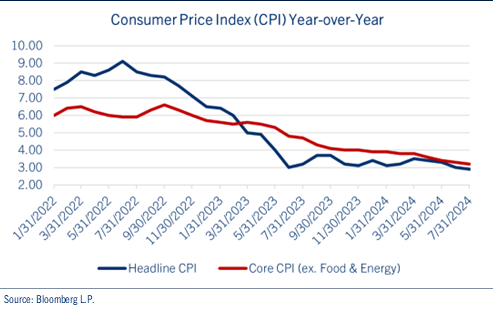

The July Consumer Price Index (CPI) report showed headline inflation slowing to 2.9% year-over-year, its slowest pace since March 2021. This marks the fourth consecutive CPI report indicating that consumer prices are rising at or below analysts' expectations. See chart: Consumer Price Index (CPI) Year-over-Year.

This trend should give the Fed additional confidence that inflation is sustainably moving toward its 2% target—a key condition for the Fed to begin cutting interest rates. We anticipate that Fed Chairman Jerome Powell will provide his clearest signals yet regarding rate cuts when he speaks at the Jackson Hole conference later this week.

Economy

July's retail sales rose 1.0% from the previous month, surpassing expectations. Given the critical role of consumer spending in the U.S. economy, this strong start to the third quarter should ease fears of a rapid economic deterioration.

Additionally, initial jobless claims came in lower than analysts expected. Coupled with the robust retail sales data, this suggests that last month's disappointing unemployment report may have been an anomaly. Indeed, the rise in last month’s unemployment report may have been influenced by a combination of factors, including the effects of Hurricane Beryl, new college graduates entering the workforce and the impact of immigration. See chart: U.S. Real GDP Quarterly Growth.

Comerica Bank Chief Economist Bill Adams projects real GDP growth of ~1.5% in both the third and fourth quarters of this year.

VIX

The CBOE Volatility Index (VIX), often referred to as the "fear gauge," has made a dramatic round-trip in just two weeks. The VIX spiked to ~65 intra-day on August 5th before settling to ~38 at the close. For context, the only times that VIX has ever reached levels above 65 were during the height of the Great Financial Crisis and the onset of COVID-19, both of which peaked above 85. See chart: CBOE Volatility Index (VIX).

Over the last two weeks, the VIX has retreated below 15, back to where it stood in mid-July and below its 30-year historical median of around 18. This rapid decline in the VIX suggests that the market's earlier fears were overblown, and that investor confidence has returned to the equity markets.

Conclusion

While the “Dog Days of Summer” did not disappoint, the improvement in economic data helped stabilize financial markets. We are certainly not out of the woods yet from a volatility perspective, though, as political and geopolitical headlines proliferate. U.S. real GDP growth remains favorable, interest rates are heading lower and corporate profits are firming. We believe these three trends will help market sentiment should any further bouts of volatility materialize in the coming months.

Be well and stay safe!

IMPORTANT DISCLOSURES

Comerica Wealth Management consists of various divisions and affiliates of Comerica Bank, including Comerica Bank & Trust, N.A. Inc. and Comerica Insurance Services, Inc. and its affiliated insurance agencies.

Comerica Bank and its affiliates do not provide tax or legal advice. Please consult with your tax and legal advisors regarding your specific situation.

Non-deposit Investment products offered by Comerica and its affiliates are not insured by the FDIC, are not deposits or other obligations of or guaranteed by Comerica Bank or any of its affiliates, and are subject to investment risks, including possible loss of the principal invested.

Unless otherwise noted, all statistics herein obtained from Bloomberg L.P.

This is not a complete analysis of every material fact regarding any company, industry or security. The information and materials herein have been obtained from sources we consider to be reliable, but Comerica Wealth Management does not warrant, or guarantee, its completeness or accuracy. Materials prepared by Comerica Wealth Management personnel are based on public information. Facts and views presented in this material have not been reviewed by, and may not reflect information known to, professionals in other business areas of Comerica Wealth Management, including investment banking personnel.

The views expressed are those of the author at the time of writing and are subject to change without notice. We do not assume any liability for losses that may result from the reliance by any person upon any such information or opinions. This material has been distributed for general educational/informational purposes only and should not be considered as investment advice or a recommendation for any particular security, strategy or investment product, or as personalized investment advice.

Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future returns. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The investments and strategies discussed herein may not be suitable for all clients.

The S&P 500® Index, S&P MidCap 400 Index®, S&P SmallCap 600 Index® and Dow Jones Wilshire 500® (collectively, “S&P® Indices”) are products of S&P Dow Jones Indices, LLC or its affiliates (“SPDJI”) and Standard & Poor’s Financial Services, LLC and has been licensed for use by Comerica Bank, on behalf of itself and its Affiliates. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services, LLC (“S&P”) and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings, LLC (“Dow Jones”). The S&P 500®® Index Composite is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, or their respective affiliates and none of such parties make any representation regarding the advisability of investing in such product nor do they have any liability for any errors, omissions, or interruptions of the S&P Indices.

NEITHER S&P DOW JONES INDICES NOR STANDARD & POOR’S FINANCIAL SERVICES, LLC GUARANTEES THE ADEQUACY, ACCURACY, TIMELINESS AND/OR THE COMPLETENESS OF THE WAM STRATEGIES OR ANY DATA RELATED THERETO OR ANY COMMUNICATION, INCLUDING BUT NOT LIMITED TO, ORAL OR WRITTEN COMMUNCATION (INCLUDING ELECTRONIC COMMUNICATIONS) WITH RESPECT THERETO. S&P DOW JONES INDICES AND STANDARD & POOR’S FINANCIAL SERVICES, LLC SHALL NOT BE SUBJECT TO ANY DAMAGES OR LIABILITY FOR ANY ERRORS, OMISSIONS, OR DELAYS THEREIN. S&P DOW JONES INDICES AND STANDARD & POOR’S FINANCIAL SERVICES, LLC MAKE NO EXPRESS OR IMPLIED WARRANTIES, AND EXPRESSLY DISCLAIM ALL WARRANTIES, OR MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE OR AS TO RESULTS TO BE OBTAINED BY COMERICA AND ITS AFFILIATES, OR ANY OTHER PERSON OR ENTITY FROM THE USE OF THE S&P INDICES OR WITH RESPECT TO ANY DATA RELATED THERETO. WITHOUT LIMITING ANY OF THE FOREGOING, IN NO EVENT WHATSOEVER SHALL S&P DOW JONES INDICES OR STANDARD & POOR’S FINANCIAL SERVICES, LLC BE LIABLE FOR ANY INDIRECT, SPECIAL, INCIDENTAL, PUNITIVE, OR CONSEQUENTIAL DAMAGES INCLUDING BUT NOT LIMITED TO, LOSS OF PROFITS, TRADING LOSSES, LOST TIME OR GOODWILL, EVEN IF THEY HAVE BEEN ADVISED OF THE POSSIBILITY OF SUCH DAMAGES, WHETHER IN CONTRACT, TORT, STRICT LIABILITY, OR OTHERWISE. THERE ARE NO THIRD-PARTY BENEFICIARIES OF ANY AGREEMENTS OR ARRANGEMENTS BETWEEN S&P DOW JONES INDICES AND COMERICA AND ITS AFFILIATES, OTHER THAN THE LICENSORS OF S&P DOW JONES INDICES.

“Russell 2000® Index and Russell 3000® Index” are trademarks of Russell Investments, licensed for use by Comerica Bank. The source of all returns is Russell Investments. Further redistribution of information is strictly prohibited.

MSCI EAFE® is a trademark of Morgan Stanley Capital International, Inc. (“MSCI”). Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

FTSE International Limited (“FTSE”) © FTSE 2016. FTSE® is a trademark of London Stock Exchange Plc and The Financial Times Limited and is used by FTSE under license. All rights in the FTSE Indices vest in FTSE and/or its licensors. Neither FTSE nor its licensors accept any liability for any errors or omissions in the FTSE Indices or underlying data.comerica.com/insights