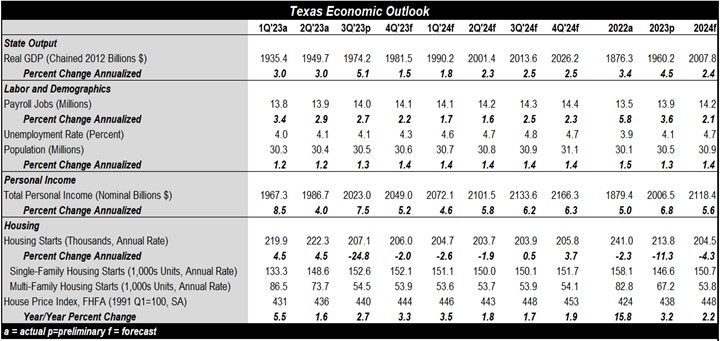

Growth to Moderate, But Still Outpace the Rest of the US in 2024

The Texan economy’s pace of growth is set to moderate in 2024, with job growth likely slowing in tandem. Recent sharp interest rate increases, high inflation, the continuation of the housing market’s correction, and softening U.S. and global economies will hold Texan growth below trend.

Texas was a big beneficiary of trends that swept the US economy in the early years of the pandemic. Americans moved from big coastal cities to Sunbelt suburbs, where businesses expanded and added jobs, household incomes and spending rose, and property markets boomed. The energy industry’s rebound reinforced these trends in Texas.

Most of the abovementioned positives lost momentum in 2023. Texans are likely to throttle back on consumer spending on the back of higher interest rates and cost of living pressures. The Fed’s tighter monetary policy has rippled through to more expensive mortgages and construction loans, big headwinds for homebuilders and house sales. Furthermore, in-migration is slowing, since would-be Texans are less eager to sell homes in other parts of the country and accept a higher interest rate on a new mortgage. The energy industry remains a bright spot, with U.S. energy production rising to record levels in late 2023.

While Texas’s economy will be cyclically slower in 2024, it will still grow substantially faster than the national economy. The Lone Star State’s economy is likely to gain momentum in the latter half of 2024, as inflation slows to a more normal rate, the Federal Reserve cuts interest rates, and inward migration reaccelerates.