Arizona Index Grew Slower in May

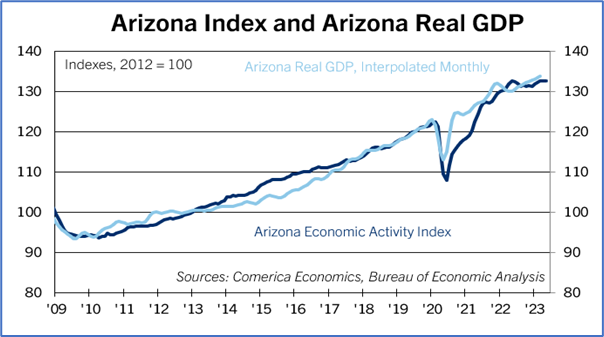

The Comerica Arizona Economic Activity Index rose by 1.5% annualized in the three months through May and was flat from a year earlier. Four of the Index’s nine constituent components rose in May, while five fell.

Arizona’s labor market weakened overall in May. The state registered its first month of job declines in 2023, as employment fell by 400. Arizona has added 21,400 fewer jobs in the first five months of 2023 than a year earlier, indicating a slowing labor market. Furthermore, continuing claims for unemployment insurance rose at the fastest pace since the depths of the pandemic in early 2020. The unemployment rate, unchanged at 3.4% for the second consecutive month, continues to be a bright spot and was below the national average rate of 3.7% in May.

Housing starts rose by 2.5% in May, but were nonetheless nearly a third lower in the first five months of the year than the same period last year. After retreating in eight of the prior twelve months, house prices fell again by a modest 0.1% in May and were 8.5% below last July’s peak. Housing’s drag on Arizona’s economy is likely to persist in coming months as high mortgage rates sideline many aspiring homebuyers.

Tourism data were mixed: seasonally-adjusted hotel occupancy rates rose in May, while air passenger volumes fell. The critical tourism sector is off to a volatile start, with hotel occupancy and air passenger volumes declining in three of the first five months of 2023. Nonetheless, they were both higher than the same period of last year, indicating tourism continues to gradually return to pre-pandemic norms. Real sales tax receipts, a proxy for consumer spending, rebounded in May, following sharp declines in the two previous months. They are down nearly two percent in the first five months of 2023 from the same time last year, pointing to weaker consumer spending.

Arizona’s economy grew 2.5% last year and expanded 2.7% annualized in the first quarter of 2023. Its growth is likely to slow in coming quarters due to persistent drags from high interest rates, high inflation, and spillovers from cooler national and global economies.