Big Upside Surprise From New Home Sales In September;

Single-Family Housing An Unexpected Beneficiary Of High Interest Rates

• New single-family home sales surprised to the upside in September.

• The median sale price fell 12.3% from a year earlier, reflecting smaller floor plans and lower prices per square foot.

• Single-family home construction and sales have been much better than expected this year, despite high mortgage rates.

• The Fed will see the year-over-year decline in sale prices as downward pressure on inflation, encouraging them to hold rates steady at their decision next Wednesday.

• Real GDP will likely accelerate to the fastest since late 2021 in the advance estimate for the third quarter.

• However, growth is set to slow in the fourth quarter due to the UAW strike, the restart of student loan payments, and a potential government shutdown.

New home sales jumped 12.3% in September to 759,000 units at a seasonally-adjusted annualized pace, much better than the 680,000 consensus forecast or Comerica’s forecast of 701,000. From a year earlier, new home sales surged 33.9%. They were up 63.3% in the Northeast, 4.7% in the Midwest, 14.6% in the South, and 7.5% in the West.

There were a seasonally-adjusted 435,000 newly-built units listed for sale at the end of September, up slightly from 432,000 in August to the highest since February. With units for sale up less than sales, listings were equivalent to 6.9 months’ supply in September, which is down from a peak of 10.1 months in July 2022. The newly-built market averaged 5.6 months’ supply between 2015 and 2019.

The median sale price (not adjusted for seasonal variations) pulled back to $419,000 from $433,000 in August, and was down 12.3% from September 2022’s median price of $478,000. The average sales price fell 4.9% year-over-year. This compares to a 2.5% year-over-year increase in the median sale price of an existing home in September, which was down slightly from 2.9% in August.

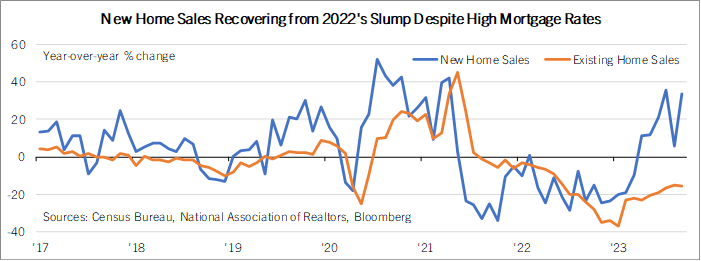

In short, new home sales have been a surprise winner of the increase in interest rates in 2023. High interest rates are a huge headwind to housing affordability and reduce demand by pricing out aspiring homebuyers. But high rates are also a big headwind to housing supply since potential sellers of existing homes are reluctant to give up low mortgage rates or tax assessments locked in prior to 2022. Homebuilders are offering buyers interest rate buydown incentives that funnel demand into the newly-built segment. They are also shrinking floorplans to boost affordability.

That is leading to very different dynamics in different parts of the housing market. Construction and sales of new homes are growing briskly. But 2023 is a terrible year for real estate agents and mortgage finance companies, whose business is more influenced by the existing homes that account for most sales.

Meanwhile, it is a confusing moment for multifamily construction. On the one hand, the households priced out of the for-sale market will need somewhere to live, which should support end-demand for rentals. On the other hand, high interest rates are a bigger obstacle for new multifamily construction than for single-family construction, since developers only need to finance single-family units until they are sold to buyers, while multifamily rental units need financing after the units lease to be profitable. On balance, single-family construction will likely grow in 2024, while multifamily construction slows from 2023’s high level.

The Fed will see the September new home sales release as supporting holding rates steady at their decision next Wednesday. The year-over-year decline in new home prices will contribute to slower inflation in 2024. The bigger economic release of this week will be tomorrow’s first estimate of third quarter GDP. It will likely show an acceleration to the fastest growth since late 2021, supported by robust consumer spending and higher energy output. U.S. oil production rose in the third quarter and hit a new record high in October.

But the third quarter’s pickup in growth is unlikely to last. Consumers splurged on travel and entertainment spending in the summer, but that seems to have cooled somewhat in the fall. The restart of student loan payments is a headwind to consumer spending by high-income highly-indebted professionals like doctors and lawyers. The UAW strike will weigh on industrial production in the fourth quarter. And a potential government shutdown would be an additional negative for the economy.

U.S. real GDP will likely grow 2.1% in 2023, but is set to slow to 1.1% in 2024 due to these headwinds, as well as the lagged effects of high interest rates and less support from fiscal stimulus.