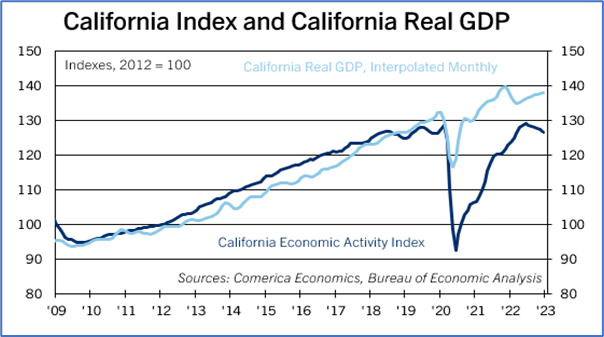

California Index Down Sharply Again in December

The Comerica California Economic Activity Index fell 4.3% annualized in the three months through December, but was still up 3.1% from a year earlier.

Only three of the nine components that constitute the Index rose in December, while six declined. Employment fell by 20,200, and continuing claims for unemployment insurance rose in the month, pointing to a weakening labor market. However, California’s unemployment rate was unchanged at 4.1%, but was 0.6 percentage points higher than the national average. The unemployment rate is likely to rise further in the coming months, as key sectors like tech face strong headwinds. California’s industrial production likely contracted in the fourth quarter given declines in industrial electricity consumption in the final three months of the year.

Housing starts cratered by 13.5% in December from November, while house prices fell for a seventh consecutive month and were down 7.8% from May’s peak. Housing affordability is a longstanding problem in California and high mortgage rates make further declines in house prices likely. The travel industry lost momentum as it entered the fourth quarter, too. The seasonally adjusted hotel occupancy rate fell 2.6 percentage points in the fourth quarter following a 1.3 percentage point decline in the third quarter. Seasonally adjusted air passenger traffic was down 8.8% in the fourth quarter after a 5.2% contraction in the third quarter. California’s economy is expected to soften in the coming months amid headwinds from a weakening housing sector, high interest rates and inflation, and slowing consumer spending. On top of these issues weighing on the national economy, the tech slowdown and the fallout from the failure of Silicon Valley Bank will be additional negatives for the Golden State.