California Index Lower in August

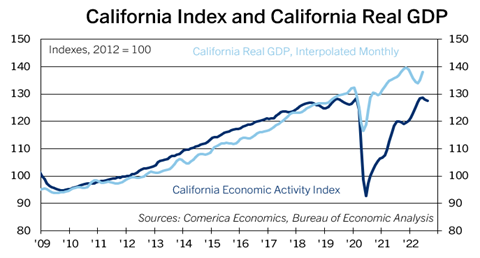

The Comerica California Economic Activity Index declined at a 2.8% annualized rate in the three months through August. The Index has slowed from the robust increases in the first half of the year. The index was still up 6.2% from a year-ago in August.

Three of the nine components that constitute the Index rose in August. California continues to enjoy strong employment gains. Electricity consumption by California’s industrial sector rebounded in the month, indicating a pickup in industrial activity. So did housing starts in the Golden State.

However, house prices fell in the California for a third consecutive month in August. Housing affordability is a longstanding problem in California and has gotten worse as first home prices and then interest rates surged post-pandemic. Declines in house prices and weak residential investment are likely going forward. In addition, air passenger traffic and hotel occupancies show the travel industry lost momentum in August, after notable gains in the second quarter.

California’s economy is expected to continue to lose momentum in the coming months, as it faces a number of headwinds, including a weakening housing sector, rising interest rates, high inflation, and slowing consumer spending. The slowdown in the tech sector, a key industry of the Californian economy, is an additional negative for the Golden State’s economy.