California Index’s Decline Moderated in January

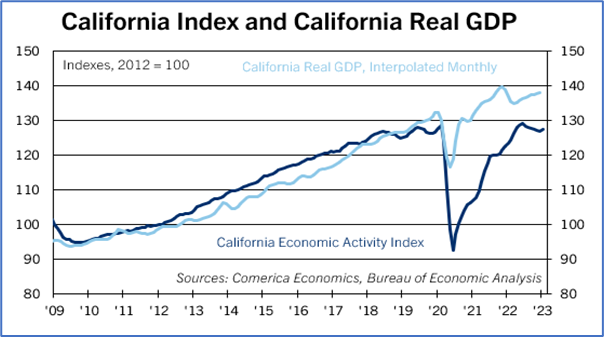

The Comerica California Economic Activity Index fell 0.3% annualized in the three months through January, the smallest such decline since July 2022. The index rose 3.2% from a year earlier.

Four of the nine components that constitute the Index rose in January, while five declined. Employment rose by a solid 67,600, but so did continuing claims for unemployment insurance. These claims have risen for six of the last seven months, suggesting a weakening labor market. California’s unemployment rate rose by a tick to 4.2%, nearly a full percentage point above the national average of 3.4%. The unemployment rate is likely to rise further near term, as key sectors like the tech industry face strong headwinds. California’s industrial production likely contracted in January as industrial electricity consumption wanes from the near-term peak last August.

Housing starts fell by 3.7% in January from December, while house prices fell for the eighth consecutive month and were down 8.2% from May’s peak. Housing affordability is a longstanding problem in California and high mortgage rates make further declines in house prices likely. The tourism sector rebounded sharply at the turn of the year from a weak second half of 2022, with seasonally adjusted hotel occupancy and air passenger volumes up sharply on the month in January.

California’s economy grew by a modest 0.4% in 2022. It is expected to soften in the coming months amid headwinds from a weak housing sector, high interest rates and inflation, and slowing consumer spending. On top of these issues weighing on the national economy, the tech slowdown and the fallout from the failure of Silicon Valley Bank will be incremental negatives for the Golden State.