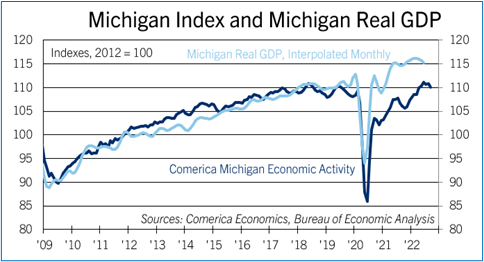

Michigan Index Declined Through September

The Comerica Michigan Economic Activity Index fell at a 3.9% annualized pace in the three months through September. Seven of the Index’s nine components were down over the period. The Index was up a solid 3.7% from the same month of last year, but that reflects a comparison against a soft patch in the fall of 2021 when the index was falling month-over-month. Michigan’s job market looks mixed, with employment up in September but continuing jobless insurance claims higher, too.

Auto production rose to a 10.3 million unit seasonally-adjusted annualized pace in September, topping the 10 million mark for the sixth consecutive month. Auto production appears to have durably recovered to more than 10 million annualized units for the first time since January ’21, and will likely post further gains as supply chain issues continue to fade. But electricity consumption by the state’s industrial sector declined in September, and house prices declined too, for a fourth consecutive month. Housing starts rose on the month. However, housing starts were down 16% in the third quarter from the second. Housing is likely to weaken further in the near-term as high prices and soaring mortgage rates weigh on affordability, a big headwind against economic growth.

More broadly, Michigan’s economy will likely slow along with the national economy into 2023. Rising interest rates are big minuses for credit-intensive parts of the economy, such as housing and commercial real estate. The auto industry will likely outperform other types of durable consumer goods manufacturing as car dealers restock inventories, but even it could face a lower speed limit on its rebound from higher interest rates.