Michigan Index Fell Through February

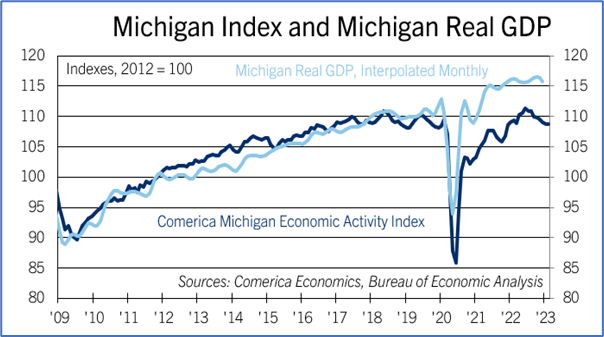

The Comerica Michigan Economic Activity Index fell 2.5% annualized in the three months through February and was down 0.5% from a year ago. Four of the index’s nine components increased in February, while four fell and one was unchanged.

The labor market was mixed in February: Employment rose by over 10,000 for the second consecutive month. But continuing claims for unemployment insurance also rose, while the unemployment rate held steady at 4.3%.

Auto and light truck assemblies continued to hover around a seasonally-adjusted annualized rate of 10 million units, indicating supply chain issues have largely abated. But electricity consumption by the state’s industrial sector fell sharply in February and was down nearly 6% from its recent peak last April. Housing starts rebounded strongly by 18.3% in February after cratering in the previous three months but were nonetheless well below February 2022’s level. Reflecting weak housing fundamentals, house prices declined again in February and were down 2.4% from their peak last May.

Michigan’s economy grew by 1.8% in 2022, slightly below the national average of 2.1%. Michigan’s economy will likely slow along with the national economy in 2023. High interest rates will slow output and sales in credit-intensive sectors, such as housing and commercial real estate investment. The auto industry will likely outperform other sectors of durable consumer goods manufacturing as car dealers restock inventories, but even it is not impervious to the effects of high interest rates and inflation on consumer demand.