Texas Index Soars in April

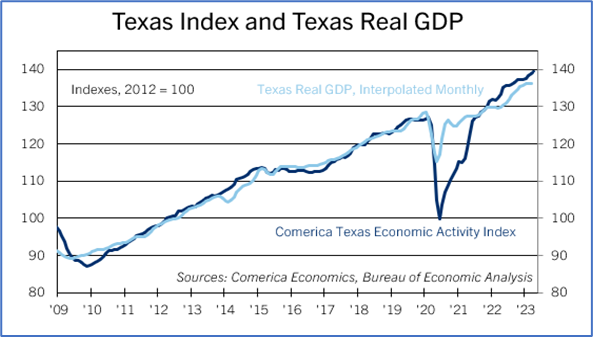

The Comerica Texas Economic Activity Index surged 5.3% annualized in the three months through April and rose 4.6% from a year earlier. Three of the Index’s nine components rose in the month, while six fell. Labor market data were mixed: Employment jumped 29,900, but continuing jobless claims also rose and were above 100,000 for an eighth consecutive month. The unemployment rate was unchanged at 4.0%.

Housing starts fell 10.4% from March and a third from a year earlier. Housing is a drag on Texas’ economy in 2023 as high mortgage rates and high prices sideline many would-be homebuyers. House prices rose in April for the first time in nine months but still fell 2.9% on the year. Strong population and employment growth are supports for Texan house prices. Seasonally-adjusted industrial electricity sales fell 1.1% from March and were little changed from a year earlier. Seasonally-adjusted active oil drilling rigs rose for the first time in eight months but were still 13% below last July’s peak. Hotel occupancy edged lower and was also roughly unchanged on the year. Consumer spending rose in April, with sales tax receipts up 1.1% on the month and 1.9% on the year.

The Texan economy grew a rapid 3.4% in 2022, well above the national average of 2.1%, and expanded at a solid 3.0% annualized pace in the first quarter, again well above the national average. While Texas will likely outpace the national economy in growth again this year, high inflation, high interest rates, and a cooler housing market will be persistent headwinds to Texas and are likely to weigh on economic activity in the latter half of the year.