Preview of the Week Ahead

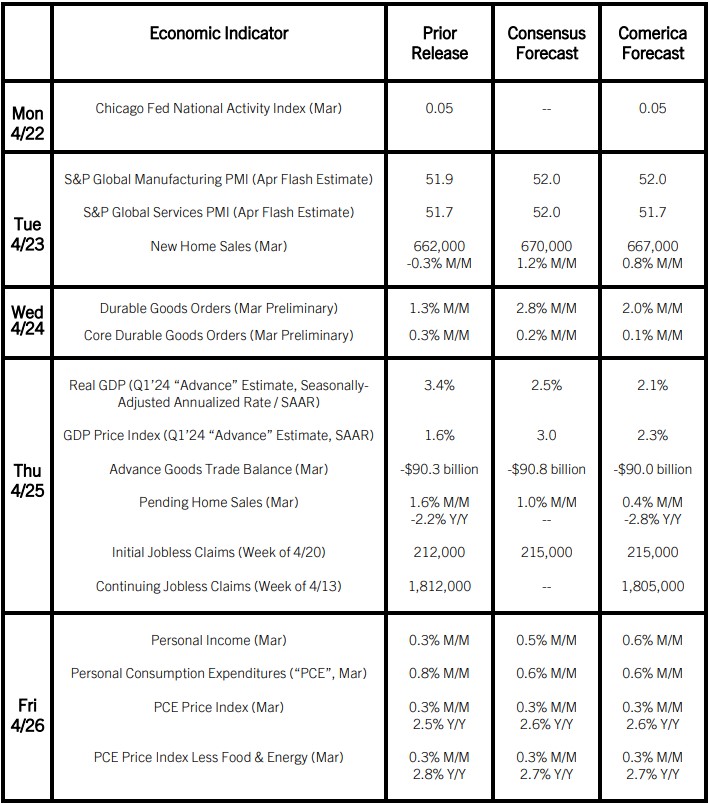

Real GDP growth likely slowed in the advance estimate for the first quarter after a 3.4% annualized increase in the fourth quarter of 2023. Residential investment likely pulled back in the first quarter, led by lower multifamily homebuilding. Spending by consumers and by federal, state and local governments were likely tailwinds to growth. Businesses’ investments in nonresidential fixed investment and inventories were likely tailwinds to real GDP in the quarter as well.

Inflation by the Fed’s preferred measure, the personal consumption expenditures price index (a.k.a. PCE Inflation), was likely little changed in March. We estimate that total inflation accelerated slightly in year-ago terms while core inflation was likely slightly lower. In six-month annualized terms, inflation has accelerated markedly since the end of 2023. PCE Inflation is running a solid notch slower than CPI inflation, primarily because it includes expenditures made on behalf of households by private health insurers, Medicare and Medicaid, and these prices are rising more slowly than overall inflation.

The personal saving rate was likely unchanged in March with both incomes and expenditures up from February. The saving rate has been quite low since 2022, possibly because statistics are undercounting income growth among recent immigrants, whose economic activity is harder to measure than long-established residents. If so, household finances could be in better shape than the saving rate suggests.

The Week in Review

Handsomely beating the 0.4% consensus forecast, sales at retail, food service and drinking establishments rose a solid 0.7% in March after an upwardly-revised 0.9% increase in February. Led by sales at nonstore retailers (primarily e-commerce), retail receipts were broadly higher, with eight of the thirteen subsectors up last month. Core retail sales, used in the estimation of nominal consumer spending on most goods in the GDP report, rose by 1.1% in March and was up 3.1% annualized in the first quarter.

March’s housing data show rising mortgage rates are weighing on housing activity. Building permits, a leading indicator of future residential construction, fell sharply by 4.3%. Housing starts, which are used in computing residential investment in the GDP report, cratered by 14.7%. Existing home sales, which account for roughly three quarters of purchases, pulled back by a steep 4.3%. For the quarter as a whole, building permits rose by a modest 0.3%, while starts fell 4.7% (not annualized). These headwinds were partially offset by sales of existing homes, up a seasonally-adjusted 8.0% last quarter.

Led by manufacturing, industrial production rose by 0.4% in March, well above the 0.1% consensus estimate. Automobile and parts manufacturing was particularly strong, up 3.1%. Utilities output rose sharply after a large decline in February. Mining output fell markedly in March. Industrial capacity utilization rose two-tenths of a percentage point to 78.4%. Industrial production disappointed in the first quarter of 2024, down 1.8% annualized, while capacity utilization’s quarterly average of 78.2% was well below the long-term average of 79.6%.