Preview of the Week Ahead

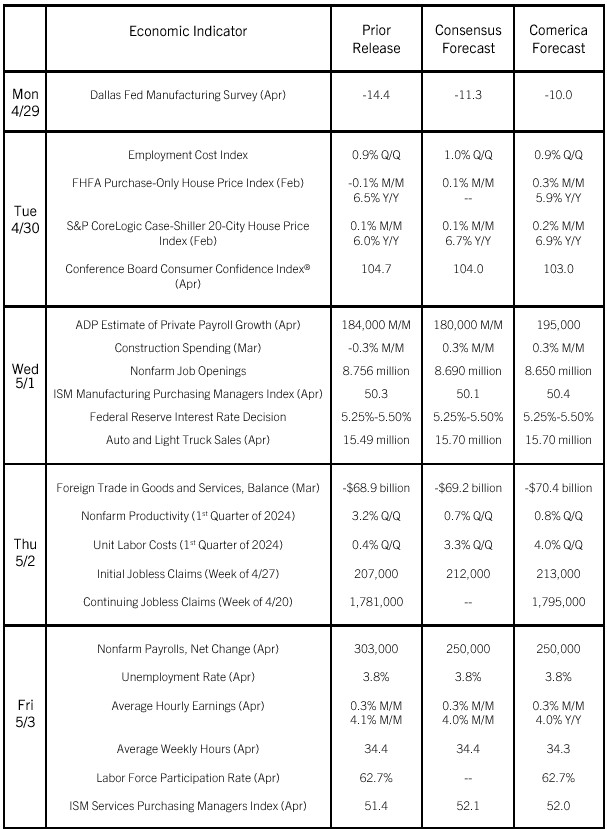

At Wednesday’s Fed decision, the Federal Open Market Committee is expected to say that the first quarter’s economic data didn’t reach their high bar to justify interest rate cuts. However, the Fed is still expected to announce details of how they will slow the run-off of their balance sheet, sometimes called tapering the quantitative tightening program, after one of the next couple of Fed decisions.

For context, the Fed pumped trillions of dollars of cash into the financial system between 2020 and 2022 to support the recovery from the 2020 recession. In mid-2022 the Fed began reducing the size of their balance sheet to reverse this stimulus, a process that continues today. Each month, the Fed is accepting repayment of up to $60 billion of the Treasuries they own as those bonds mature, and up to $35 billion in mortgage-backed securities (MBS). They reinvest maturing amounts that exceed this cap. As the Fed accepts repayment, they drain cash from the financial system and the economy. After one of the next few Fed decisions, they will likely reduce the monthly limit for Treasury repayments to around $30 billion from $60 billion, and hold unchanged the monthly limit on mortgage-backed security repayments (Actual MBS repayments vary from month to month, rising in months with more existing home sales, falling in months with fewer, since the mortgage pre-payments by home sellers are currently the biggest driver of MBS pre-payments). The Fed will probably end balance sheet reduction in late 2024 or early 2025.

Friday’s jobs report will likely show American employers added jobs solidly again in the month of April, while average hourly earnings growth moderated again in year-over-year terms to the slowest pace since mid-2021.

The Week in Review

Real GDP growth slowed to 1.6% annualized in the first quarter of 2024, below the 2.5% consensus forecast or Comerica’s forecast of 2.1%. This marked real GDP’s slowest quarter since the first half of 2022. From a year earlier, real GDP grew 3.0% in the first quarter after 3.1% growth a quarter earlier. A big part of the first quarter’s slowdown was due to businesses adding to inventories more slowly, and because the trade deficit widened. Slower growth of government spending was another headwind. The Fed won’t mind seeing real GDP growth slow, since the labor market is still in very good shape.

The bigger concern from last week’s data releases was hot inflation by the Fed’s preferred measure, the Personal Consumption Expenditures (PCE) price index. PCE inflation in March was 0.3%, as was core PCE inflation excluding food and energy, both matching economic forecasters’ expectations. But PCE inflation was revised slightly higher in January and February, causing year-over-year PCE inflation to accelerate to 2.7% in March from 2.5% in February, and core PCE inflation to hold unchanged at 2.8%; both were slightly higher than expected. In the PCE report, inflation of service prices excluding energy and housing a.k.a. Supercore PCE inflation was 0.4% in March after 0.2% in February and 0.7% in January. In year-over-year terms, Supercore PCE inflation was 3.5% in March following 3.4% in February and 3.6% in January—all considerably higher than the Fed’s 2% target.