Preview of the Week Ahead

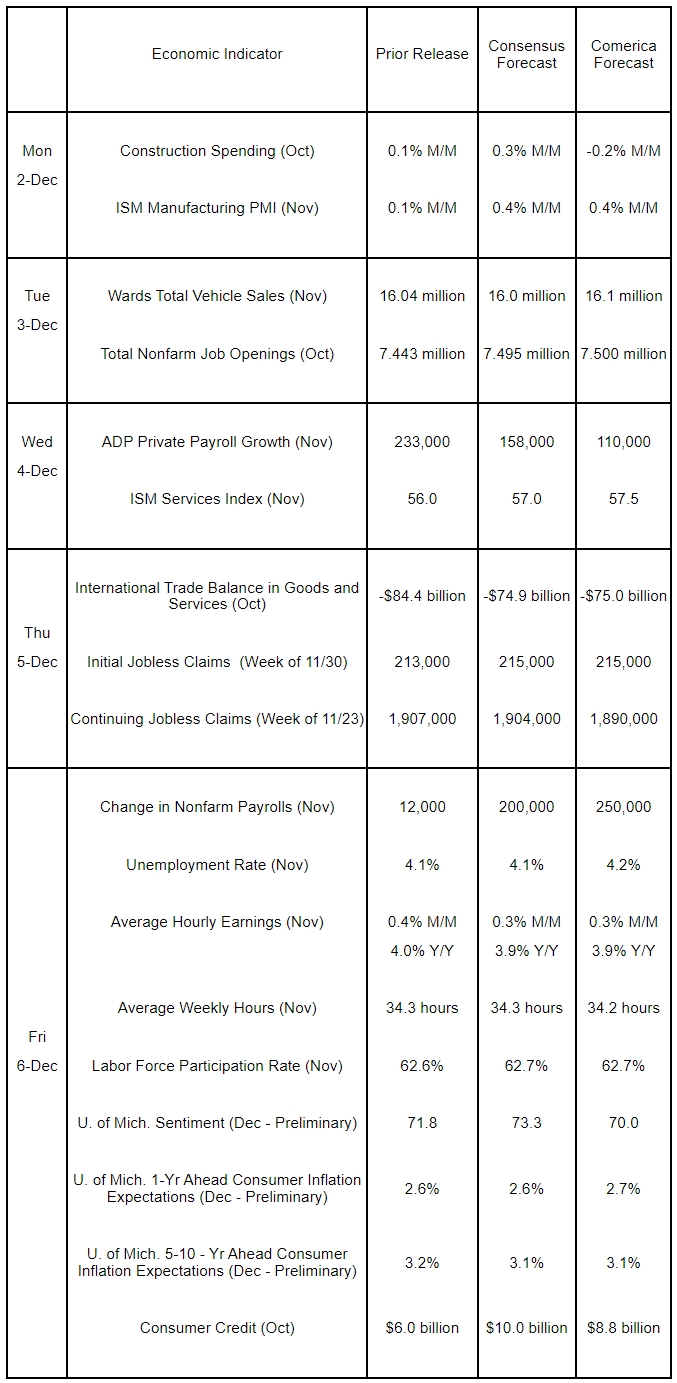

The spotlight this week will be on key labor market data releases and the ISM PMIs. With impacts of hurricanes Helene and Milton in the rearview mirror, hiring is expected to have rebounded in November. Wages and salaries probably rose at a moderate pace, likely holding annual wage inflation around four percent. As they waited for clarity about the election outcome, employers likely held job openings steady in October. Financial markets will scrutinize ISM manufacturing and services PMIs for affirmation of the strong uptick in new orders, employment, and business confidence reported by S&P Global in its November flash estimates released about a fortnight ago.

The Fed will likely report consumer credit expanded moderately in October. November vehicle sales data and University of Michigan’s preliminary read of Consumer Sentiment for December will offer markets additional insights on the health of the consumer post-election. The trade report will garner greater attention than usual, as the president-elect has vowed to use tariffs extensively to reduce the trade deficit.

The Week in Review

Monetary policymakers expressed confidence “inflation was moving sustainably toward 2 percent,” and assessed labor market conditions remained “solid,” according to the minutes of their November meeting. They deemed economic activity as “largely stronger than anticipated.” Concluding further rate cuts were warranted, policymakers judged “it would likely be appropriate to move gradually toward a more neutral stance of policy over time.” The emphasis on ‘gradual’ rate cuts is a sign that the Fed is likely to cut rates at some meetings in 2025, but skip a change in other meetings. Markets will get a better steer of policymakers’ plans for 2025 at the December 18th FOMC meeting, when the Fed publishes forecasts for key economic indicators and the fed funds rate for the next three years.

As expected, third quarter economic growth was unrevised at 2.8% annualized in the second estimate of real GDP. Consumer spending, which accounts for roughly two-thirds of the economy, was revised down marginally to a still very strong growth rate of 3.5% annualized. There were no material revisions to either the GDP deflator or the Personal Consumption Expenditures (PCE) Price Index, both of which rose less than 2% annualized last quarter.

Led by a sharp increase in wages and salaries, personal incomes rose a stronger-than-expected 0.6% in October. Spending was up 0.4% and was solely driven by household expenditures on services. The lack of spending on goods, however, is not surprising as consumers splurged on both durable and nondurable goods in the prior month. The savings rate increased to 4.4% in October from a downwardly revised 4.1% in September. Largely matching Comerica Economics’ forecasts, headline and core PCE inflation rose by 0.2% and 0.3%, respectively, for the second consecutive month and were up 2.3% and 2.8% from a year earlier. Progress on reducing core PCE inflation appears to be losing steam, with the gauge stalled between 2.6% and 2.8% for six months running.

For a PDF version of this publication, click here: Comerica Economic Weekly, December 2, 2024(PDF, 143 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.