Preview of the Week Ahead

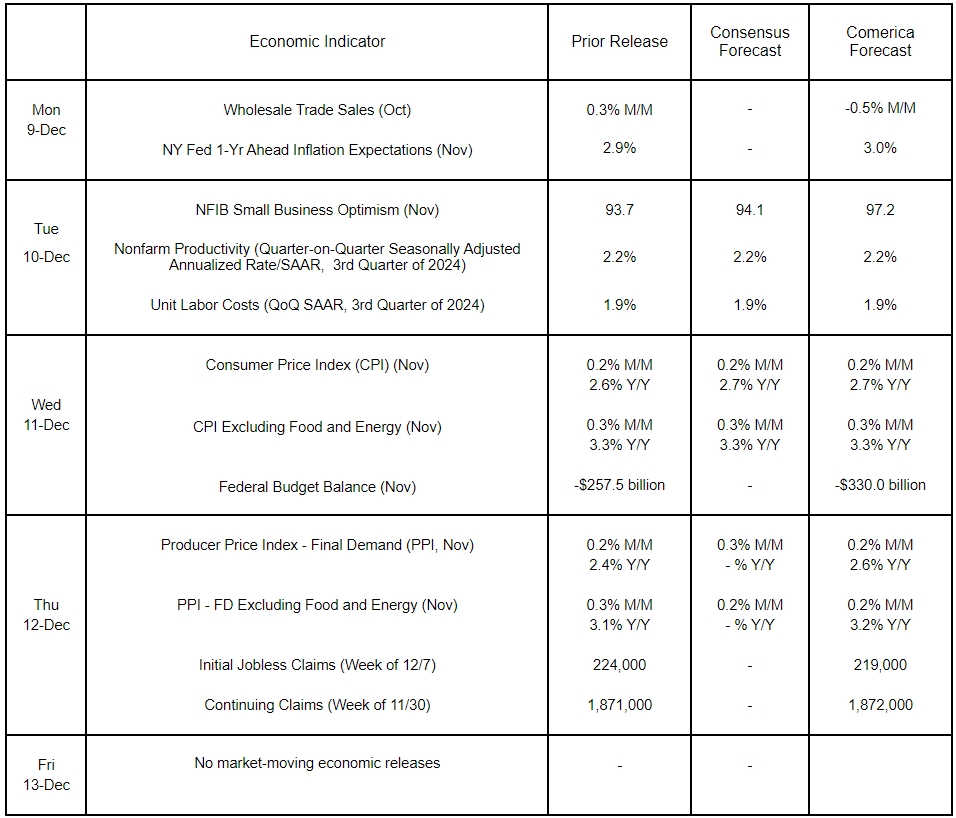

Following last month’s solid jobs report, financial markets will focus on inflation releases this week, the last major data ahead of the Fed’s December interest rate decision. The headline and core Consumer Price Index (CPI) likely rose at the same pace in November as in the prior month resulting in steady annual inflation. Producer prices probably rose moderately in November, but faster in year-over-year terms due to base effects. The New York Fed will likely report year-ahead inflation expectations edged higher, but remained well-anchored in the latest Survey of Consumers.

The Treasury will likely again announce a high federal deficit for November. Markets probably will pay more attention to the Treasury’s monthly statement than usual, as the president-elect has stated reducing government spending and deficits as some of his foremost priorities. Small business optimism likely jumped post-election, as business owner sentiment brightens in anticipation of tax and regulatory relief in the coming months.

The Week in Review

Employers added 227,000 to payrolls in November, above the 220,000 consensus. The prior two months’ payrolls were revised up a combined 56,000. The unemployment rate changed little at 4.2%. The average workweek edged up by 0.1 hour to its long-term average of 34.3 hours. The labor force participation rate fell to 62.5%. The labor force participation rate of workers aged between 25-54 years, considered to be in their “prime” working years, held steady at 83.5% for the second consecutive month, but was half a percentage point below the nearly 25-year high of 84.0% recorded in July. Average hourly earnings rose by 0.4% on a monthly basis and 4.0% on an annual basis for the second month running.

Job openings rose to 7.744 million in October from the downwardly revised 7.372 million vacancies in the prior month, with the private sector accounting for almost all the increase. Vacancies in government, the second largest recruiter in the past year, have fallen sharply in recent months.

Consumer sentiment rose by 3.1% to a seven-month high of 74.0% in the December preliminary release. A nearly 14% jump in the current conditions component raised the overall index. The future expectations index retreated sizably. There was no clear signal from consumers’ inflation expectations, with year-ahead expectations rising, but long-term inflation expectations edging lower.

The ISM purchasing manager surveys were mixed in November. The ISM Manufacturing PMI rose by nearly two percentage points to 48.4% and beat the 48.1% consensus. The return to expansion of new orders after seven months of contraction was a notable positive, as was a slower increase of prices paid. The ISM Services PMI, on the other hand, tumbled unexpectedly by nearly four percentage points to 52.1% and missed the 57.0% consensus. The business activity subindex, which gauges current production, and the new orders subindex, an indicator of future production, both fell notably by nearly three and a half percentage points, but still held above 50, indicating continued expansion.

For a PDF version of this publication, click here: Comerica Economic Weekly, December 9, 2024(PDF, 143 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.