Preview of the Week Ahead

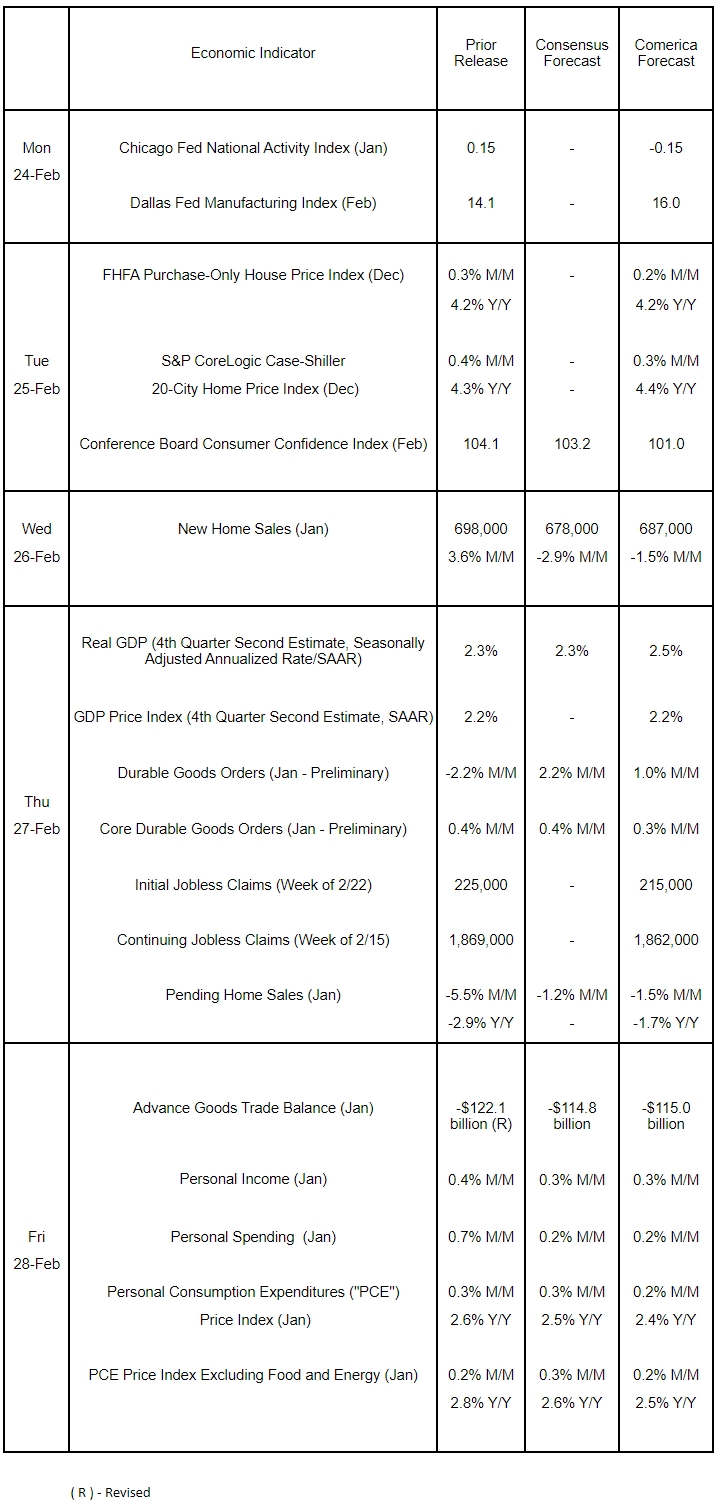

The week’s most important economic releases include the second estimate of fourth quarter GDP, personal income and outlays for January as well as the Fed’s preferred measure of inflation, and consumer confidence for February. GDP growth is forecast to be revised higher in the second estimate due to upward revisions to residential and nonresidential investment. Both personal income and outlays likely grew slower in January after robust gains in December. The trade deficit in goods probably narrowed in January after widening sharply in December. Concerns about tariffs and layoffs of Federal employees and contractors likely weighed on consumer confidence, pushing the index down for a third consecutive month. House price increases likely moderated in the final month of last year.

The Week in Review

The minutes of the Fed’s January meeting provide few new insights about the interest rate outlook, since the meeting was soon after inauguration and the Fed’s policymakers were too uncertain about the new administration’s policies to send clear guidance. However, they did signal that run-off of their balance sheet (a.k.a. “Quantitative Tightening” or QT) might pause or slow in the coming months as federal government borrowing approaches the debt ceiling and potentially causes swings in bank reserves. Comerica forecasts for QT to end in July 2025.

Housing data weakened in January. The NAHB / Wells Fargo Housing Market Index (HMI) fell by five points to a five-month low of 42. All three constituent components of the HMI retreated, with the homebuilders’ sales expectations for the next six months plunging to the lowest since late 2023 on fears of tariffs on imported lumber and appliances. Impacted by adverse weather, housing starts cratered by 9.8% to an annualized rate of 1.366 million units in January. Building permits rose a very modest 0.1% to an annual rate of 1.483 million units. Existing home sales declined sharply by 4.9% in January to an annualized rate of 4.080 million. The median sales price fell by nearly $7,000 on the month to $396,900, but was still up 4.8% from a year earlier; median sales prices have risen between 2% and 6% on the year since the fall of 2023. Home listings were 3.5 months of supply at January’s rate of sales.

Private sector business activity weakened in February, according to the flash release of S&P Global’s PMI surveys. The services PMI fell into contractionary territory as federal spending cuts worried institutions reliant on public funding. Manufacturing rose, but the report warned that some of the increase was likely due to manufacturers front-running tariffs. New orders and business expectations for the year ahead slumped.

The University of Michigan’s Index of Consumer Sentiment fell to 64.7 in the final reading for February from 67.8 in the preliminary release and was the weakest since November 2023. Consumers’ perceptions of current conditions and future expectations deteriorated notably, with expectations for unemployment tying for the most negative since 2011. Year-ahead inflation expectations held steady at 4.3% from the preliminary reading, when they jumped to the highest since November 2023. Long-term inflation expectations worsened over the month to 3.5% and were the highest in nearly 30 years.

For a PDF version of this publication, click here: Comerica Economic Weekly, February 24, 2025(PDF, 157 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.