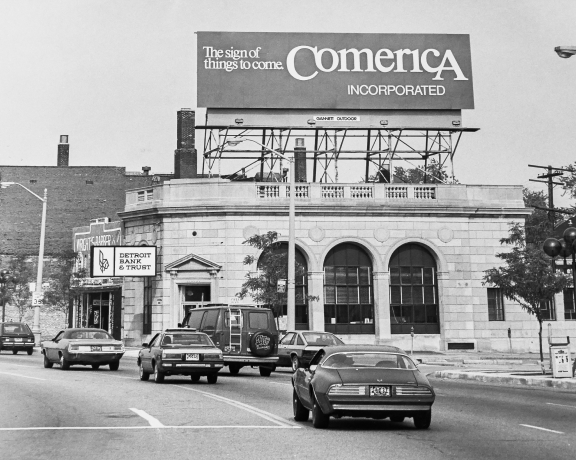

Comerica Web Banking®

Log in to other Comerica services

- Comerica Central

- Web Banking for Small Business

- Comerica Business Connect

- Comerica Financial Advisors

- Comerica GlobalTRADE Web

- Comerica Business Deposit Capture

- Comerica eFX

- Comerica Money Market Manager

- Comerica Credit Card

- Comerica Wealth Connect

- Comerica Trust Online

- Benefits Payments Online

- Comerica Commercial Card