Preview of the Week Ahead

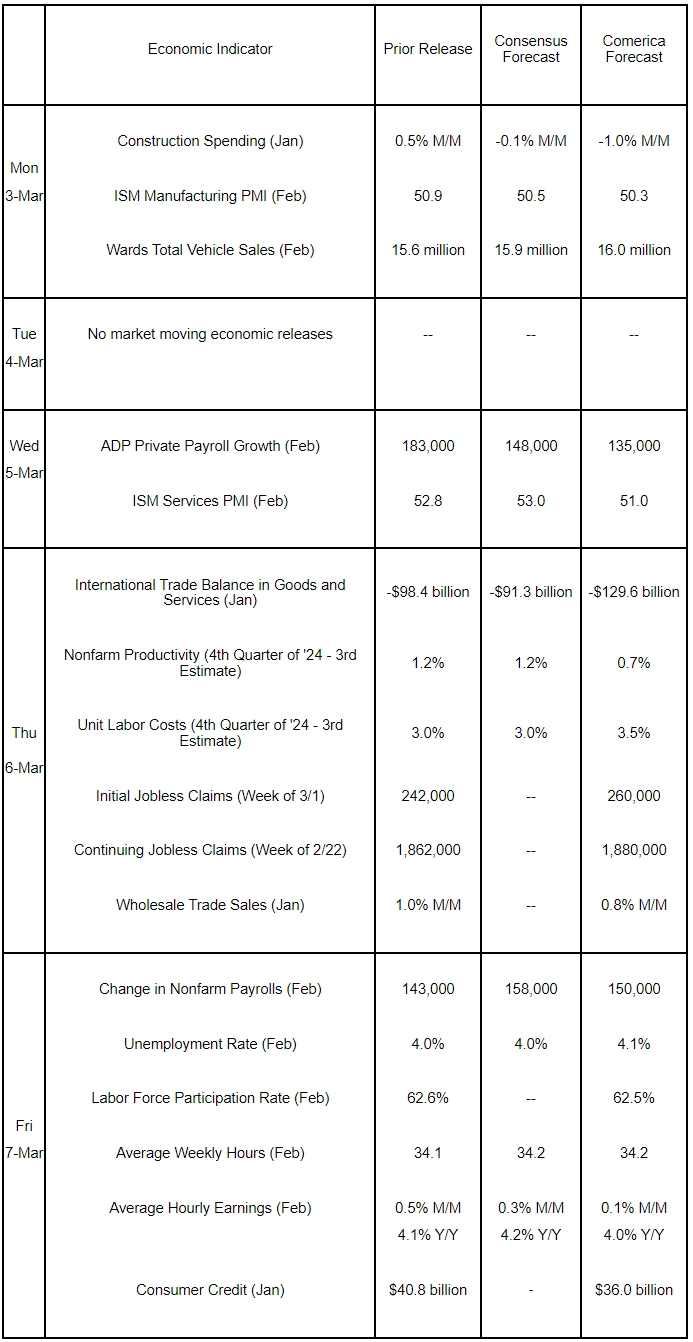

The February jobs report and the ISM PMIs will be this week’s key data releases. Employment likely rose at a subdued pace again, while the unemployment rate likely edged higher. The DOGE cuts were a headwind to the job market last month, offsetting the recovery of jobs paused during January’s winter storms. Wage increases were likely modest as lower-paid hourly workers returned to work after the weather kept them off the clock in January. The ISM Manufacturing PMI probably will show a second consecutive month of expansion, while the ISM Services PMI likely took another leg down. Construction spending likely pulled back sharply in January during the bad weather. Consumer credit likely rose sharply for a second consecutive month.

The Week in Review

Fourth quarter economic growth was unrevised at 2.3% annualized in the second estimate of real GDP. Consumer spending growth was also unchanged at a rock-solid 4.2% annualized. Government spending was revised up, offsetting a downward revision to private fixed investment and a wider trade deficit. The revisions, overall, indicate domestic demand was slightly lower, but still very healthy in the final quarter of last year. Inflation was revised up, raising both the GDP price index and the personal consumption expenditures (PCE) price index, the Fed’s preferred inflation barometer.

Supported by broad increase in wages and salaries, business and capital income, and government benefits, personal income jumped 0.9% in January. Household spending fell by 0.2%, likely affected by the bad weather, LA wildfires, the flu season, and lower consumer confidence (The Conference Board’s Consumer Confidence Index fell again in February to the lowest since June). The saving rate jumped to 4.6 percent in January, the highest in seven months. Headline and core PCE price indices rose by 0.3% on the month. The PCE price index rose 2.5% from a year earlier, while the core PCE index eased to a 2.6% increase and tied for the slowest since March 2021.

New and pending home sales both plunged in January. New homes sales fell by 10.5% to an annualized rate of 657,000 units, much worse than the 1.2% decline predicted by the consensus. The inventory of new homes for sale increased to 9.0 months of supply at January’s rate of sales. The median sales price rose for a second consecutive month and was up 3.7% from a year earlier to $446,300. Pending home sales, derived from contract signings to purchase an existing home and so a leading indicator for future existing home sales, fell by 4.6% in January to an all-time low. House prices rose at a faster pace in December and ended the year on a strong note, though. The S&P CoreLogic Case-Shiller 20-City House Price Index rose by 0.5% in December and pushed annual house price increases to 4.5% from 4.3% in November. The FHFA Purchase-Only House Price Index increased by 0.4% for the second month running, with the annual increase accelerating to 4.7% from 4.5% in November.

Led by a 9.8% increase in transportation equipment orders, new orders for durable goods rose by 3.1% in January from a downwardly revised 1.8% fall in December. Nondefense capital goods excluding aircraft, a widely followed proxy for business investment in equipment, rose by a solid 0.8%.

For a PDF version of this publication, click here: Comerica Economic Weekly, March 3, 2025(PDF, 148 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.