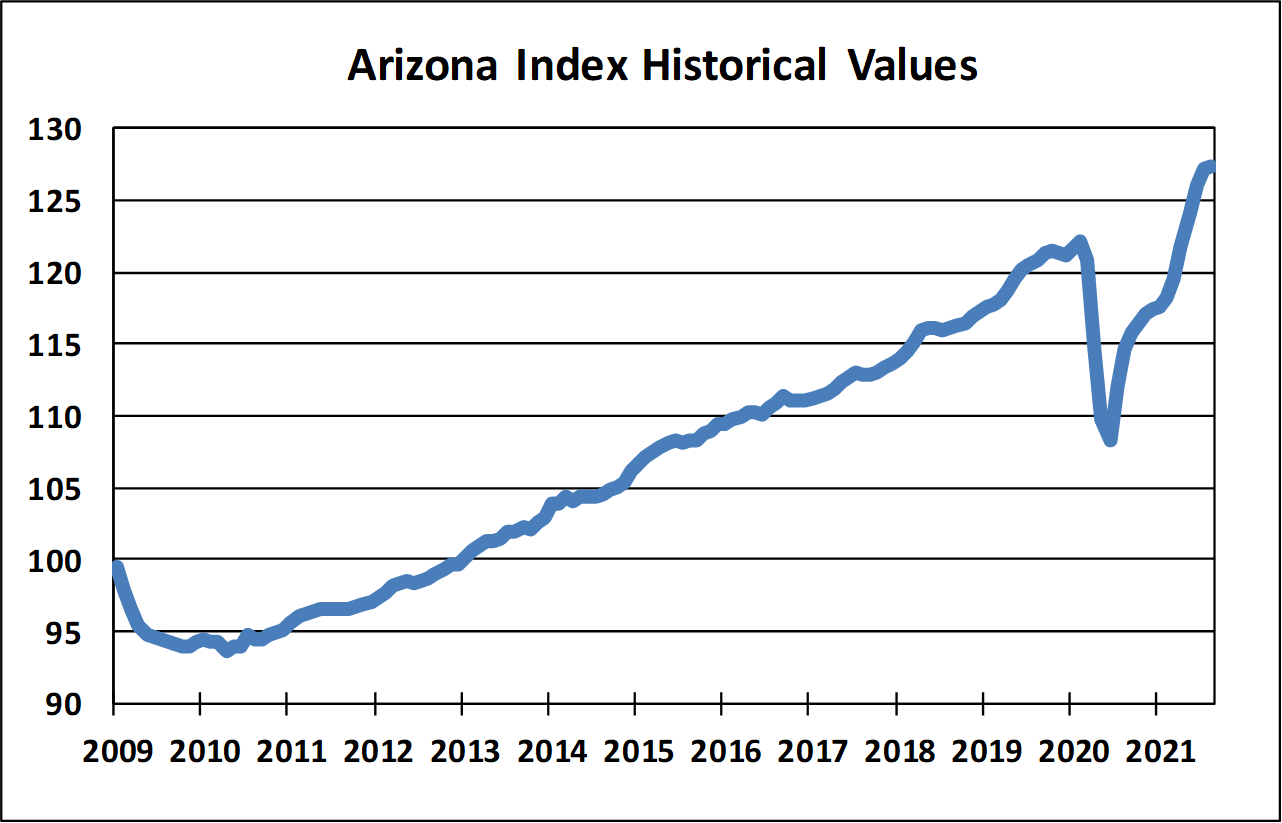

Comerica Bank’s Arizona Economic Activity Index increased in August to a level of 127.3. August’s index reading is 17.7 percent above the recent low of 108.2 set in June 2020. The index averaged 115.9 for all of 2020, 4.0 points below the average for 2019. July’s index reading was unrevised at 127.2.

Our Arizona Economic Activity Index increased by 0.1 percent in August, marking the fourteenth consecutive monthly gain. There were more index components down than up for the month, the first time this has occurred since January. The three gainers were nonfarm employment, unemployment insurance claims (inverted) and house prices in August. Six of the components fell for the month including housing starts, industrial demand for electricity, total state trade, hotel occupancy, state taxable sales and total enplanements. The Arizona Index all but stalled in August as the late-summer COVID surge and supply constraints weighed on key sectors of the Arizona economy. We could see some soft data over the next couple of months driven by recent declines in employment. After leading the U.S. labor market recovery for most of 2021, Arizona posted back-to-back monthly declines in nonfarm payrolls in August and September. We still expect the Arizona Index to move back to stronger growth by year end. Domestic travel will likely pick back up as COVID cases continue to decline this fall. Demand for Arizona housing remains strong, but supply is limited. This is rapidly pushing up house prices. The Phoenix area led the nation’s largest cities with house prices up 33.3 percent for the year ending in August, according to the Case-Shiller data. Housing affordability may be a headwind, but Arizona will remain more affordable than many other states.