Download the (PDF, 750 KB)2025 Market Outlook

Cautious with a Chance of Inflation

As we consider the prospects for 2025, our best theme is: Cautious with a Chance of Inflation. Uncertainties continue to cloud the economic outlook, with questions about the timing and impact of the policy shifts planned by the next President. Even so, economic growth looks likely to be solid this year, supporting continued growth of corporate earnings and reassuring markets that the near-term risk of a recession is low. While the earnings outlook looks upbeat, in our opinion, earnings multiples could face headwinds from elevated longer-term interest rates, heavy Treasury issuance, and a potentially priced-for-perfection starting point for the year

Since the start of 2024, the U.S. economy has made significant progress towards a “soft landing.” GDP growth has slowed to a still-solid 2.7% year-over-year rate, and inflation has eased in tandem to a bit above the Fed’s 2% target (as measured by the personal consumption expenditures price index, their preferred inflation measure). The data flow allowed the Fed to begin cutting the target for their policy rate to 4.25%-4.50% at the start of 2025, down from 5.25%-5.50% a year earlier.

For 2025, our base case for the macro economy is a continuation along this soft-landing path, supported by continued albeit slower cuts by the Fed. Our forecast assumes steady growth of consumer spending supported by healthy increases of real disposable income, favorable labor market conditions, and inflation behaving better than in 2022 or 2023.

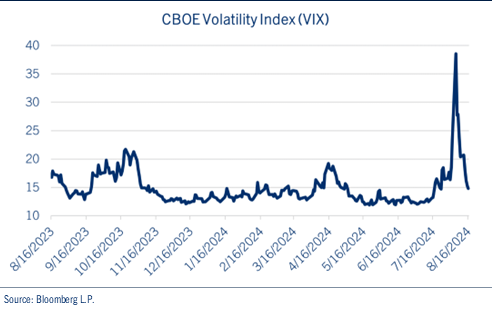

The big policy shifts planned by the incoming administration are the biggest known-unknowns influencing this outlook. Higher tariffs, restrictive immigration policies, tax cuts and energy deregulation could have complex and potentially offsetting impacts on equity earnings and valuations. On the one hand, higher tariffs and fewer immigrant workers could slow or even reverse the Federal Reserve’s rate cuts, a headwind to corporate cashflows and valuations. On the other hand, tax cuts would allow investors to keep a larger share of pre-tax earnings and make equities more valuable. In addition, global risks continue to hang over the market, including the wars in the Middle East and Ukraine, the H5N1 flu, and the cost of more frequent and expensive natural disasters. These risks could raise market volatility after a relatively calm 2024.

While our view of the earnings outlook is fundamentally upbeat, we view the outlook for earnings multiples more cautiously. Although the global economy is more balanced than a year or two ago, and central banks have cut rates in support of economic growth, equity valuations are entering the year already high by historical standards. In the U.S., the S&P 500 is trading at 22 to 24 times forward earnings, well above historical normal levels of 15 to 17 times earnings. That means that not only are risk-free bond yields higher than the dividend yield of the typical stock, but they are also higher than the stock’s overall earnings yield, too—including dividends, repurchases, and reinvested earnings. Historically, high valuations have not sent a reliable signal about near-term equity market performance, but they do suggest that investors should make more conservative assumptions about longer-term returns than when they invest in a cheaper market.

Every year provides challenges for investors, and 2025 won’t be any different. Given the past two years of outsized equity returns, we remain focused on risk to reward ratios, which currently point to a greater focus on income, valuations and risk management. As always, our focus is on helping our clients stay invested and positioned in appropriately diversified strategies, consistent with their long-term investment objectives and tolerance for risk.

Macroeconomic Backdrop

Slower, but still stong

- The U.S. economy powered forward in 2024, growing 2.7% and handily outpacing the consensus forecast of 1.3% at the start of the year. We see a continuation of that trend this year, with growth holding above the economy’s longer-term trend rate.

- Inflation has cooled substantially. Comerica forecasts for price increases to hold steady in a range of 2.5% to 3.0% in 2025, as measured by the price indexes most closely followed by Fed policymakers. Higher tariffs could raise inflation and discourage the Fed from cutting rates more aggressively, as could more restrictive immigration policies (since a shortage of workers could put upward pressure on wage increases).

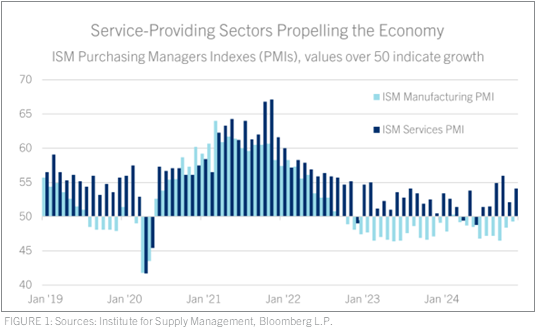

- The Purchasing Manager’s Index (PMI) signals economic growth holding steady at the turn of the year, powered by expansion of service-providing business activity.

- AI-driven productivity gains could begin to materialize in 2025, potentially helping to reduce inflation. These gains will likely become more apparent over the next decade. Improved productivity of conventional and renewable energy production is another potential disinflationary catalyst in 2025.

- Comerica Bank Chief Economist Bill Adams projects real GDP growth of 2.7% for 2025, and an increase in the CPI of 2.8%.

- House sales will likely grow modestly in 2025, with similarly modest increases in house prices. While fundamental demand is strong, affordability pressures are preventing a faster rebound of housing activity.

- Commercial real estate could be at an inflection point as lower borrowing costs and improving business sentiment help to unlock pent-up demand and deal flow.

- Internationally, the current global monetary easing cycle will likely support economic growth and risk assets but may be offset by geopolitical concerns and trade war fears.

Fiscal Policy

Increasing Federal Debt: How Much is Too Much?

- At 6.3% of GDP in the 2023-2024 fiscal year, the federal fiscal deficit is unprecedently high for a peacetime economy at full employment.

- A near-term fiscal crisis seems unlikely in the U.S. The level of debt in the hands of the public, at around 100% of GDP at the end of 2024, is well below the 200%-plus levels that the Japanese economy has sustained over the last fifteen years without triggering a crisis.

- However, the federal government’s finances are on an unsustainable path, with policy on course to push debt to levels that would begin to crowd out private access to credit and increase the risk of a systemic crisis.

- More immediately, the increased issuance of Treasuries and rising federal interest expense are upside risks to bond yields and headwinds to equity multiples in 2025.

Fixed Income

Adapting to a Changing Yield Cycle

- The Federal Reserve cut rates 100 basis points between September and December 2024 but signaled rate cuts would likely be slower in 2025, and are likely to end with the federal funds rate above the prior cycle’s peak (2.25-2.50% in 2018 and 2019). The Fed’s current economic projections a.k.a. “Dot Plot” indicates two potential cuts of a quarter percent each in 2025, conditional on inflation remaining well behaved.

- Despite the Fed cutting short-term rates in late 2024, longer-term bond yields have risen. This likely reflects improved expectations for economic growth in 2025, but also higher inflation expectations, as well. We expect this “bull steepener” trend to continue with short-term rates falling, offset by a larger differential between short- and longer-term rates, and for the 10-year U.S. Treasury yield to range from 4.25% to 4.75% over most of 2025.

- Bond markets delivered solid returns in 2024 as yields provided value again. Most importantly, the year saw important factors develop. The macro backdrop has finally become helpful to fixed income investors again: A global rate cut cycle is under way, the Treasury yield curve has “un-inverted” as short-term yields decline, and there are good prospects for the curve to steepen further in 2025.

- Fixed income markets are intently focused on U.S. debt sustainability. With the U.S. debt supply surging while foreign central banks are cutting their exposure to the dollar, Treasury term premiums seem likely to range considerably higher in the next few years than during the aberrant low-rate cycle of 2009 to 2020. This steepening could trigger more volatility of the kind seen in 2013 and 2016. But since much of the move has already been realized, Comerica is maintaining a neutral view on duration positioning and developing strategies to help investors take advantage of volatility as it arises.

- The last two years have been solid for credit exposure. Due to economic growth and strong corporate earnings, credit spreads are as tight as they have been in the last 26 years.

- High yield spreads price in a high degree of optimism. Comerica suggests investors monitor their exposure and not overextend when markets are richly valued.

- Comerica continues to be optimistic in our view of bonds in 2025. Given reasonable levels for yields and stability in higher-quality bonds, we see these asset classes as potential beneficiaries of reallocation of investment portfolios toward risk control.

- While some of the low-hanging fruit have been harvested, the bond markets still offer risk control and useful diversification, especially in the higher-rated segment of the market.

- After two opportunistic years, we are looking for “coupon-type” returns in bonds to support diversified portfolios in 2025.

Equities

Rotating for Risk Management

- Equity performance has been dominated by mega-cap tech companies for the last few years, fueled in part by robust earnings, but also by exuberant levels of optimism. We anticipate an important broadening of market contribution in the next phase of the investment cycle. Despite the amazing earnings growth of the “Magnificent 7,” their even-more-amazing valuations and the relative undervaluation of large value, mid cap and small cap stocks lead us to see these other segments of the market as attractive diversifiers against the risk that the richest segment of the market falls short of expectations.

- The S&P 500® index is weighted by its constituents’ market capitalizations and its top-heavy concentration is now near multi-decade highs. The summer sell-off of 2024 gave way to new highs at year-end, and Comerica believes that 2025 may prove a year when value comes into vogue again. With valuations high, interest rates moderating, and profit margins expanding, we see great potential for productivity gains and earnings growth for large-value, small-cap and mid-cap companies, which have lagged the S&P 500® over the last two years.

- Value stocks are trading at a historically wide discount. At the start of 2025, value traded at a 63% discount to growth stocks based on a normalized forward price-to-earnings ratio basis. This is well above the normal 43% discount that they have averaged over the last 40 years.

- From these levels, we believe that value offers a margin of safety in an environment where the range of possible market outcomes is wide.

- Foreign central banks have also begun a rate cutting process as inflation has moderated across the globe and economic output has stabilized. With policy rates starting this year near their highest levels in many decades, central banks have more economic levers to pull than in the prior two economic cycles. They will have room to cut rates and reduce borrowing costs in 2025 which should allow them to keep economic growth stable and avoid recession.

- Considering the escalation of geopolitical tensions, the IMF projects global growth to slow to 3.0% in 2025, down from 3.2% in 2024. These projections are slightly below the global economy’s long-term trend and points to flattish earnings growth for foreign equities. The prospect of escalating tariffs presents a further risk to international economic growth. U.S. equities are likely better positioned than foreign equities to perform in this scenario. The risk of a more severe impact of trade frictions internationally leads us to be cautious in our international allocation, and within the U.S. presents an opportunity for small caps to outperform as they tend to be more domestically-oriented.

- U.S. equities rose 25% in 2024, following a 26% increase in 2023. These were the best two back-to-back years since the 1990s. Returns are rarely this high for two consecutive years, and it is even more rare to have such high returns for three consecutive years.

- Nevertheless, we look for equity index increases to approximate per-share profit growth this year as elevated market interest rates suggest P/E multiples will at best hold stable. Economic and earnings fundamentals do continue to point to a more typical year for returns. Profitability growth is being driven by productivity gains due to advancing technology and IT, where the U.S. has an advantage as an innovation center, where margins are wider, and where barriers to entry are higher.

- Our below-consensus S&P 500® EPS forecast of 7.0% suggests the Index would be fairly valued in the 6,300 range at the end of 2025.

2025 Forecast - Closing Summary

Equities:

- Favor Quality Stocks: At this stage of the cycle, companies with strong balance sheets have historically performed well, and currently trade at reasonable prices.

- If Indexing, Consider Equal-Weighted Indexes Over Market-Weighted Indexes: The equal-weighted index trades at a 25% discount to its market-weighted peer.

- Favor Defensive Sectors in Your Asset Allocation: With obvious downside risks to global growth and valuations high, defensive sectors can outperform cyclicals, even without a recession.

Bonds:

- Monitor Duration Positioning Within Fixed Income: As short-term interest rates have dropped, the reinvestment yield on money market and short-term bonds has and will continue to reset lower. Maintain a modest duration / maturity profile to protect today’s relatively high yields.

- Extend Bond Portfolio Duration: We anticipate liquid credit returns to decline due to low credit spreads and anticipated lower central bank policy rates. When the yield curve was inverted, short-term bonds were favorable. As the yield curve steepens, extending the duration of bond portfolios presents positive yield and total return opportunities, in our view.

- Investment Grade Core Fixed-Income: Treasuries, municipal bonds and corporate debt all look attractive for yield over 5%. Spreads are relatively tight, but are well supported by low downgrade risks and high credit quality.

- Low Equity Risk Premiums Favor Bonds: Equity valuations have risen such that the risk premium of the S&P 500® is just barely positive. While valuations are an imperfect way to predict near term movements, current expectations for bond returns and equity returns are nearly the same.

Real Assets:

- Public Infrastructure & Energy Appear Poised to Perform: U.S. consumption remains strong and energy consumption is increasing due to rising demand from AI and Blockchain applications. Proposed supportive regulations for energy to fuel the AI boom could provide incremental upside to the sector.

- U.S. Private Real Estate Investments Positioned Well: Returns of private real estate investments slowed in 2024 due to the rapid rise in interest rates. The Fed’s recent rate reductions reduce the cost of borrowing and expand net operating income for private real estate investors. We believe this could unlock pent-up demand and dealmaking.

- Macro/Geopolitical Risks Magnify the Value of Diversifiers: Macroeconomic risks, including wars in the Middle East and Ukraine, high equity valuations and the threat of potential reinflation under the new U.S. administration make diversifiers like gold, other metals, and commodities more attractive.

2025 appears to us to promise a year of economic transition. With global challenges in full view and a more favorable growth outlook for the U.S. than other developed economies, we maintain a preference for domestic over international exposures in long-term, diversified portfolios. We continually monitor for changes and will update our view as we see the impact of new policies in the U.S. and the world.

IMPORTANT DISCLOSURES

Comerica Wealth Management consists of various divisions and affiliates of Comerica Bank, including Comerica Bank & Trust, N.A. Inc. and Comerica Insurance Services, Inc. and its affiliated insurance agencies.

Comerica Bank and its affiliates do not provide tax or legal advice. Please consult with your tax and legal advisors regarding your specific situation.

Non-deposit Investment products offered by Comerica and its affiliates are not insured by the FDIC, are not deposits or other obligations of or guaranteed by Comerica Bank or any of its affiliates, and are subject to investment risks, including possible loss of the principal invested.

Unless otherwise noted, all statistics herein obtained from Bloomberg L.P.

This is not a complete analysis of every material fact regarding any company, industry or security. The information and materials herein have been obtained from sources we consider to be reliable, but Comerica Wealth Management does not warrant, or guarantee, its completeness or accuracy. Materials prepared by Comerica Wealth Management personnel are based on public information. Facts and views presented in this material have not been reviewed by, and may not reflect information known to, professionals in other business areas of Comerica Wealth Management, including investment banking personnel.

The views expressed are those of the author at the time of writing and are subject to change without notice. We do not assume any liability for losses that may result from the reliance by any person upon any such information or opinions. This material has been distributed for general educational/informational purposes only and should not be considered as investment advice or a recommendation for any particular security, strategy or investment product, or as personalized investment advice.

Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future returns. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The investments and strategies discussed herein may not be suitable for all clients.

The S&P 500® Index, S&P MidCap 400 Index®, S&P SmallCap 600 Index® and Dow Jones Wilshire 500® (collectively, “S&P® Indices”) are products of S&P Dow Jones Indices, LLC or its affiliates (“SPDJI”) and Standard & Poor’s Financial Services, LLC and has been licensed for use by Comerica Bank, on behalf of itself and its Affiliates. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services, LLC (“S&P”) and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings, LLC (“Dow Jones”). The S&P 500®® Index Composite is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, or their respective affiliates and none of such parties make any representation regarding the advisability of investing in such product nor do they have any liability for any errors, omissions, or interruptions of the S&P Indices.

NEITHER S&P DOW JONES INDICES NOR STANDARD & POOR’S FINANCIAL SERVICES, LLC GUARANTEES THE ADEQUACY, ACCURACY, TIMELINESS AND/OR THE COMPLETENESS OF THE WAM STRATEGIES OR ANY DATA RELATED THERETO OR ANY COMMUNICATION, INCLUDING BUT NOT LIMITED TO, ORAL OR WRITTEN COMMUNCATION (INCLUDING ELECTRONIC COMMUNICATIONS) WITH RESPECT THERETO. S&P DOW JONES INDICES AND STANDARD & POOR’S FINANCIAL SERVICES, LLC SHALL NOT BE SUBJECT TO ANY DAMAGES OR LIABILITY FOR ANY ERRORS, OMISSIONS, OR DELAYS THEREIN. S&P DOW JONES INDICES AND STANDARD & POOR’S FINANCIAL SERVICES, LLC MAKE NO EXPRESS OR IMPLIED WARRANTIES, AND EXPRESSLY DISCLAIM ALL WARRANTIES, OR MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE OR AS TO RESULTS TO BE OBTAINED BY COMERICA AND ITS AFFILIATES, OR ANY OTHER PERSON OR ENTITY FROM THE USE OF THE S&P INDICES OR WITH RESPECT TO ANY DATA RELATED THERETO. WITHOUT LIMITING ANY OF THE FOREGOING, IN NO EVENT WHATSOEVER SHALL S&P DOW JONES INDICES OR STANDARD & POOR’S FINANCIAL SERVICES, LLC BE LIABLE FOR ANY INDIRECT, SPECIAL, INCIDENTAL, PUNITIVE, OR CONSEQUENTIAL DAMAGES INCLUDING BUT NOT LIMITED TO, LOSS OF PROFITS, TRADING LOSSES, LOST TIME OR GOODWILL, EVEN IF THEY HAVE BEEN ADVISED OF THE POSSIBILITY OF SUCH DAMAGES, WHETHER IN CONTRACT, TORT, STRICT LIABILITY, OR OTHERWISE. THERE ARE NO THIRD-PARTY BENEFICIARIES OF ANY AGREEMENTS OR ARRANGEMENTS BETWEEN S&P DOW JONES INDICES AND COMERICA AND ITS AFFILIATES, OTHER THAN THE LICENSORS OF S&P DOW JONES INDICES.

“Russell 2000® Index and Russell 3000® Index” are trademarks of Russell Investments, licensed for use by Comerica Bank. The source of all returns is Russell Investments. Further redistribution of information is strictly prohibited.

MSCI EAFE® is a trademark of Morgan Stanley Capital International, Inc. (“MSCI”). Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

FTSE International Limited (“FTSE”) © FTSE 2016. FTSE® is a trademark of London Stock Exchange Plc and The Financial Times Limited and is used by FTSE under license. All rights in the FTSE Indices vest in FTSE and/or its licensors. Neither FTSE nor its licensors accept any liability for any errors or omissions in the FTSE Indices or underlying data.comerica.com/insights