Key Takeaways:

- Understanding asset classes and the risk associated with each is key to building the appropriate asset allocation for your stage in life.

- Diversification is the concept of not putting all your investment eggs in one basket. It is also one of the best risk management tools for long-term returns available to investors.

- When reviewing your portfolio, it is important to identify an appropriate benchmark to judge how well your portfolio is performing.

Over the last 30 years, the stock market has averaged almost 10% annual returns.

To capture your share of market increases, it’s essential to balance the risk and return of your investment portfolio. In this article, we’ll expand on Part 1: Getting Started on Your Investment Journey recommendations and provide a roadmap for constructing your optimal investment portfolio.

Portfolio construction

There are 3 steps to portfolio construction. Each step represents an important consideration for the long-term success of your investments:

Step 1: Asset allocation

As stated in Getting Started on Your Investment Journey, the first step to building an investment portfolio is determining the appropriate asset allocation. The purpose of asset allocation is to create a diversified portfolio that balances risk and return based on your goals and objectives, risk tolerance and time horizon.

The appropriate asset allocation is a significant factor in maximizing returns relative to your risk tolerance. The asset allocation includes various types of investments that meet the asset allocation targets. Examples of these sub-asset classes include large-cap, mid-cap, small-cap, or international equities, short-term, mid-term, long-term, or high-yield fixed income and specialty assets like commodities. Diversification is part of this process.

Risk v. Reward

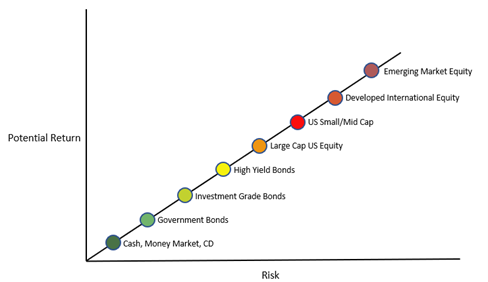

As the saying goes, no risk, no reward. This is true when considering investments. Generally speaking, the higher the investment risk, the higher the expected return. The graph below highlights various assets classes and illustrates the relationship between risk and potential return. This data illustrates that while emerging markets for example has historically had higher overall returns, its volatility has been much higher than bonds or cash.

Each investment type carries its own risk and return potential.

Importance of diversification

Diversification is the concept of not putting all your eggs in one basket. It is also one of the best risk management tools available to investors. Diversification allows you to spread your risk across multiple asset classes

The chart below shows the Periodic Table of Returns for most asset classes over the past 20 years. You will see that what did well one year did not necessary do as well the next. You will also notice the more consistent asset classes within the chart. Diversified asset allocation strategies tend to provide the smoothest return scenario.

The Callan Periodic Table of Investment Returns conveys the strong case for diversification across asset classes (stocks vs. bonds), capitalizations (large vs. small) and equity markets (U.S. vs. global ex-U.S.). The Table highlights the uncertainty inherent in all capital markets. Rankings change every year. Also noteworthy is the difference between absolute and relative performance, as returns for the top-performing asset class span a wide range over the past 20 years. Source: Callan Institute

It is also important to consider assets that are not in a client investment portfolio when considering diversification. For example, a real estate developer may not have any real estate assets due to the allocation outside the portfolio. These assets outside the portfolio for business owners also reflect the amount of risk they might be willing to take in the portfolio. For example, if they take significant risk in their business, they may want a much less aggressive portfolio that is focused on income, stability and less volatility regardless of their age and stage.

Diversification reduces the risk that any one investment can affect your entire portfolio.

Step 2: Security choices

Within each type of investment, there will be specific security choices. Security selection is a crucial element of portfolio construction. Security selection is the process of determining which stocks, bonds and/or cash will be included in the portfolio. For example, the advantage of a mutual fund is diversification of securities without significant investment.

Income tax implications of the chosen securities is an important consideration. A portfolio that is more growth oriented is likely to have less income tax implications than an asset allocation that is more oriented towards income.

If retirees have pensions, social security and other cash flow sources that meet their income needs, there may be less of a need for income than another retiree. Those retirees that do not need their investment income for retirement cash flow may be investing for their heirs and have a more aggressive asset allocation.

Step 3: Portfolio monitoring

Once your portfolio is implemented you will want to periodically monitor the portfolio to ensure it is meeting your goals and expectations. It is also important to revisit your goals and objectives, ideally through the exercise of financial planning including cash flow analysis, to ensure the portfolio is still appropriate.

An individual’s asset allocation will change through different life stages and as goals shift over time. Generally, a younger employed person will have a more aggressive asset allocation than a person who is close to or in retirement. If there is a lifetime need for income, regardless of age, that will also shift the asset allocation. At each life stage and as the market changes, you and your advisor may choose to rebalance your portfolio.

When reviewing your portfolio, you may evaluate data such as year-to-date return, yield, income, dividends, capital gains or losses and interest. These are all metrics for considering how your portfolio is working for you. Total return, which includes capital appreciation of your assets, interest, dividends and other income, is how you would gauge the actual performance of the portfolio.

You will also want to determine if rebalancing the portfolio is necessary. Rebalancing is the process of buying or selling securities to keep the assets classes and securities in your portfolio within the target range set during the asset allocation process.

Having an appropriate benchmark is also important. The benchmark is what we compare a portfolio to for the purpose of judging how the portfolio is performing versus a similar basket of investments. For example, the S&P 500® Index is often used as a standard equity market index. This represents the 500 largest stocks by market cap in the U.S. It is important to make sure you are comparing your portfolio to an appropriate index. If you have a 60/40 portfolio, 60% stocks and 40% bonds, you will not want to strictly use the S&P 500® as your benchmark. You would want to include a bond index such as the Barclays Bloomberg Aggregate Bond Index that measures.

The purpose of these comparisons is to see how your portfolio is performing versus the similar securities, or if a security selection is causing underperformance and should be revisited. A different security in that same asset class may have better returns for the same amount of risk.

Use the S&P 500® Index as a helpful benchmark to measure your investment returns.

Portfolio construction that represents your goals and objectives, risk and time horizon is important for long-term investing. Ensuring the portfolio is well diversified and that you are reviewing the portfolio at least twice a year against appropriate benchmarks is important for long-term return. Long-term return includes asset appreciation and various types of income.

Engaging with a wealth management team that can provide cash flow projections is important to ensure that your portfolio continues to help you meet your goals. If you want to know more, please reach out to your Comerica Relationship Manager or contact Comerica Wealth Management to discuss your portfolio and investment goals.

NOTE: IMPORTANT INFORMATION

Comerica Wealth Management consists of various divisions and affiliates of Comerica Bank, including Comerica Bank & Trust, N.A. and Comerica Insurance Services, Inc. and its affiliated insurance agencies. Non-deposit Investment products offered by Comerica and its affiliates are not insured by the FDIC, are not deposits or other obligations of or guaranteed by Comerica Bank or any of its affiliates, and are subject to investment risks, including possible loss of the principal invested. Comerica Bank and its affiliates do not provide tax or legal advice. Please consult with your tax and legal advisors regarding your specific situation.

This is not a complete analysis of every material fact regarding any company, industry or security. The information and materials herein have been obtained from sources we consider to be reliable, but Comerica Wealth Management does not warrant, or guarantee, its completeness or accuracy. Materials prepared by Comerica Wealth Management personnel are based on public information. Facts and views presented in this material have not been reviewed by, and may not reflect information known to, professionals in other business areas of Comerica Wealth Management, including investment banking personnel.

The views expressed are those of the author at the time of writing and are subject to change without notice. We do not assume any liability for losses that may result from the reliance by any person upon any such information or opinions. This material has been distributed for general educational/informational purposes only and should not be considered as investment advice or a recommendation for any particular security, strategy or investment product, or as personalized investment advice.