California Index Rises Sharply in April

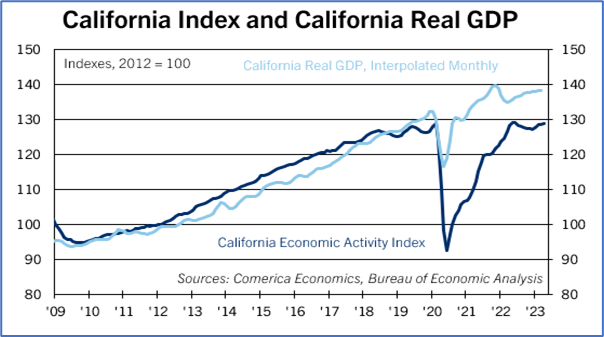

The Comerica California Economic Activity Index rose 3.8% annualized in the three months through April and was up a modest 0.4% from a year earlier.

Three components of the index rose in April, while six declined. Employment rose sharply by 69,900. The good news on employment was marred by a 41,300 increase in unemployment insurance claims —the biggest monthly increase since July 2021—and by a further increase in the unemployment rate to 4.5%, which was 1.1% above the national average of 3.4%. California’s industrial production likely rose modestly in April as industrial electricity consumption ticked up.

Housing starts have been volatile so far in 2023 and fell by about a fifth in the first four months of the year from the same period in 2022. Led by increases in California’s three largest metro areas—Los Angeles, San Diego, and San Francisco—house prices rose for the third consecutive month by 1.1%, though they were still down 6.2% from last May’s peak. Seasonally-adjusted hotel occupancy and air passenger traffic were mixed in April, with the former easing by 0.8% and the latter rising by 1.2%. Total real state fiscal revenues fell sharply in the month, largely reflecting a big drop in corporate tax receipts.

California’s economy grew by a modest 0.4% in 2022. It expanded by 1.2% annualized in the first quarter, comfortably above last year’s growth, but lagging the national economy’s 2.0% expansion. California’s economy is expected to remain soft in the coming months amid headwinds from a weak housing sector, high interest rates and inflation, and slowing consumer spending. On top of these issues weighing on the national economy, the tech slowdown will be an incremental negative for the Golden State.