Florida Index Unchanged in November

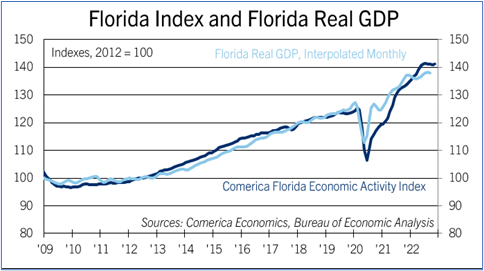

The Comerica Florida Economic Activity Index was unchanged in the three months through November. The Index rose robustly in the first half of last year but lost steam in the second half. The index was up 5.6% in November from a year earlier.

Just three of the index’s nine components rose in November, while five declined and one was unchanged. Employment rose for the 31st consecutive month by 22,300. Continuing jobless claims, which jumped in October, fell in November as Florida’s labor market began to heal from the devastation caused by Hurricane Ian. Florida’s unemployment rate fell to 2.6% and was a full percentage below the national average of 3.6%.

Housing starts fell in November and are considerably lower than in the first half of last year. House prices are down, too, for the fourth consecutive month and are 2.3% below their peak last July. After prices rose much faster than incomes between the onset of the pandemic and early 2022, and then mortgage interest rates surged, housing activity is likely to pull back over the next few quarters. Hotel occupancy, adjusted for seasonality, fell in November, as did air passenger volumes for the fourth consecutive month. Hurricane Ian’s impact on Florida’s critical tourism sector continued to linger through year-end. Also, tourism spending softened nationally in late 2022, affecting Florida.

Looking forward, Florida’s strong labor market and population growth will help the Sunshine State weather a cooler national economy. However, Florida’s economic growth will be slower in 2023 than in 2022 due to headwinds from high inflation, rapidly rising interest rates, and spillovers from weaker national and global economies.