Texas Index Declined in September

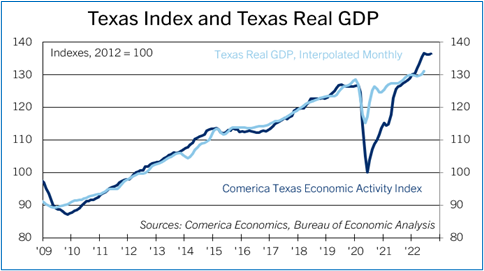

The Comerica Texas Economic Activity Index declined at a 0.6% annualized rate in the three months through September. The index has slowed sharply after robust increases in the first half of the year. The index was up 7.0% from a year earlier in September.

Six of the index’s nine components declined in September. Employment continues to rise in Texas and the number of employed is about 600,000 above the pre-pandemic level. Active oil-drilling rigs fell in the month, though, as energy prices moved lower. The energy sector could be less supportive of growth going forward.

Housing starts fell 17.5% in the third quarter compared to the second. Texas’s housing market is set to be a big drag on the state’s economy, as surging mortgage interest rates and high prices push would-be homebuyers to the sidelines. House prices declined for the third consecutive month in September, and further declines are likely in the coming months.

Texas GDP rose by 1.8% in the second quarter of 2022 and just 0.5% in the first quarter. The slowdown of the Comerica Texas Index shows the state’s economy slowed down sharply in the third quarter following a strong second quarter. High inflation, surging interest rates, a softening national economy, and weak economies outside the US will be persistent headwinds in Texas, likely causing growth in the state to hold below trend into 2023.