CPI Picked Up in December, While Core CPI Slowed;

Slower Core CPI Is Clearing a Path for the Fed to Cut Rates This Year

• CPI accelerated in December due to uneven base comparisons with late 2023.

• However, the core CPI slowed to the least since the spring of 2021.

• Prospects are good for inflation to slow further in 2024.

• Lower inflation is clearing a path for the Fed to reduce interest rates.

The CPI rose 0.3% in December, slightly overshooting the consensus expectation for a 0.2% increase and following 0.1% in November. From a year earlier, the CPI picked up to a 3.4% increase from 3.1% in November. Food prices rose 0.2%, with food at home up 0.1% and food away from home up 0.3%. Energy prices rose 0.4%, with gasoline up a seasonally-adjusted 0.2% on the month and down 1.9% from a year earlier.

The core CPI excluding food and energy rose 0.3%, matching the consensus forecast and unchanged from November. From a year earlier, core CPI slowed to a 3.9% increase from 4.0% in November, slightly above the 3.8% consensus, but was still the slowest since the spring of 2021. Within the core basket, the “Supercore CPI” of services excluding housing and energy services rose 0.4% in December and matched November’s increase. From a year earlier, Supercore CPI rose 3.9% and likewise was unchanged from November. The Fed is closely watching Supercore CPI to look through the volatility in housing costs over the last few years and suss out inflation’s underlying trend.

The pickup of inflation in December largely reflects uneven base comparisons with late 2022, when the price of gasoline dropped sharply. By comparison, gasoline prices fell a little less than usual between November 2023 and December 2023, which showed up as a seasonally-adjusted monthly increase in the CPI Gasoline component. According to AAA, whose daily gas report does not adjust for recurring seasonal patterns, a gallon of gas at the pump averaged $3.14 in December, down from $3.33 in November and below the $3.22 of December 2022. Gas prices have risen less than the average of all consumer prices over the last few years—gas averaged $2.90 between 2010 and 2019, again according to AAA. Natural gas prices fell more in December, down 13.8% year-over-year, and home heating oil was down 14.7%. U.S. petroleum production is at a record high, and the adoption of renewables and energy-efficient technologies is eating into domestic demand for refined products. That is keeping prices in check despite the war in the Middle East.

The shelter component of the CPI is rising faster than normal, but it, too, is slowing. It was up 6.2% on the year in December, down from 6.5% in November and a peak of 8.2% in March. Shelter CPI tracks the average price of Americans’ housing costs, creating a lag between the surge in house sale prices and new residential leases in 2021 and 2022 and the surge in shelter inflation as measured by the CPI. The Fed’s aggressive interest rate hikes have thrown sand in the gears of the housing market, slowing home price appreciation, and residential leases are rising more slowly as a wave of new multifamily construction comes to market. As shelter CPI slows, so will core CPI, since shelter accounts for two fifths of the CPI basket excluding food and energy.

New and used vehicle prices rose on the month in December, but this is likely a fluke. Inventories on dealer lots are rising; consumers have more choices among models for sale, increasing competition; and high auto loan rates are constraining demand. Wholesale prices for used vehicles at auction fell 0.5% on the month and 7.0% on the year in December; retail prices will likely follow wholesale prices lower in 2024.

The biggest frustration for consumers in the CPI report is restaurant prices. Food away from home rose 5.2% from a year earlier in December—by comparison, prices of food at home rose just 1.3%. Food away from home’s increase is down from March’s multidecade peak of 8.8%, but still faster than any time between 1983 and 2020. Wages for lower-paid occupations like restaurant jobs are growing faster than the U.S. average, creating price pressures that restaurants are passing on in higher prices.

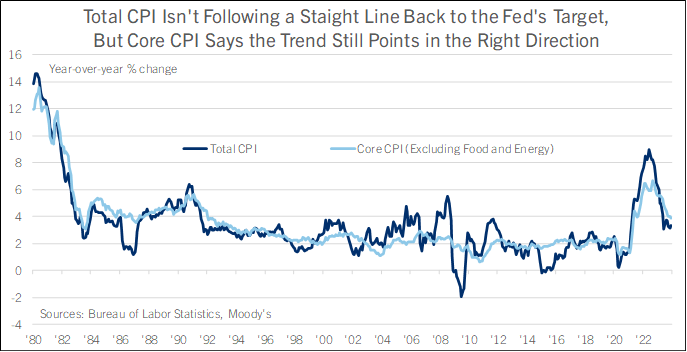

The path for inflation to get back to the Fed’s target is not a straight line. Even so, the big picture is that the economic dislocations caused by the pandemic are fading, economic growth is settling into a more normal pace, and labor shortages are much less of an issue, collectively guiding inflation back toward normal.

Slower inflation will clear a path for the Fed to begin lowering interest rates this year. Financial markets price in high odds of the Fed beginning to cut the federal funds rate as early as March. Comerica forecasts for the Fed to proceed more cautiously than financial markets price in. The Fed got burned by underestimating the intensity of inflation’s surge over the last few years, and they would rather overcorrect and keep rates high for longer than necessary than cut too early and allow inflation to rebound. Hawks among the FOMC’s members will likely point to Supercore CPI as evidence that high inflation could be persistent—it has gone sideways since September.

Comerica forecasts for the Fed to wait until June to begin reducing the federal funds target and to reduce it by three quarters of a percentage point between then and December. Given financial markets’ optimism that inflation is headed in the right direction, risks are skewed toward an earlier and faster reduction in interest rates.