Michigan Index Rebounded in May

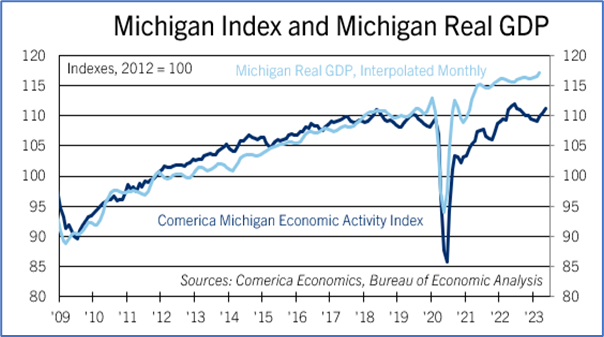

The Comerica Michigan Economic Activity Index jumped 7.9% annualized in the three months through May. The Index was still down 0.3% from a year earlier after declining in the second half of 2022. Six of the index’s nine components increased in April, while three fell.

Overall, the Great Lake State’s labor market improved in May. Employment rose for the seventh consecutive month by a solid 11,400. While continuing claims for unemployment insurance were higher, the unemployment rate fell to the lowest since early 2020 and matched the national average of 3.7%.

Auto and light truck assemblies rose to 11.3 million annualized units in May and are back to the highest since mid-2020 as the chip shortage fades in the rear-view. Industrial electricity use fell in May but was nonetheless about 2% higher in the first five months of 2023 than the same period last year. Housing starts rose sharply for the second consecutive month, but are still down a fifth in the first five months of the year from the same period in 2022, as rising unaffordability restrains residential construction. With listings tight, house prices rose sharply for the third consecutive month and have now fully reversed their decline from mid-2022 to early-2023. Seasonally-adjusted hotel occupancy rose on the month and from a year earlier. Real consumer spending is a little weaker in 2023 than last year: Sales tax receipts, adjusted for seasonality and price differences, edged up in May, but were still down about 2% from a year earlier.

Michigan’s economy grew by 1.8% in 2022, slightly below the national average of 2.1%. The trend held in the first quarter, with Michigan’s real GDP growth of 1.7% a tad below the nation’s 2.0%. Michigan’s economy will likely slow along with the national economy in late 2023 and into 2024. High interest rates will slow output and sales in credit-intensive sectors, such as housing, manufacturing, and commercial real estate investment. The auto industry is outperforming other sectors of durable consumer goods manufacturing as car dealers restock inventories, but even it is not immune to the negative impacts of high interest rates and inflation on consumer demand; a large number of new EV models brought to market in 2023 and 2024 is increasing pricing competition and could weigh on carmakers’ margins.