Producer Price Inflation Slowed in April; Jobless Claims Higher in Early May

• Both total and core producer price inflation was slightly below expectations in April.

• Initial jobless claims rose more than expected in early May.

• The Fed is more likely to start cutting interest rates later this year than hold them unchanged into 2024.

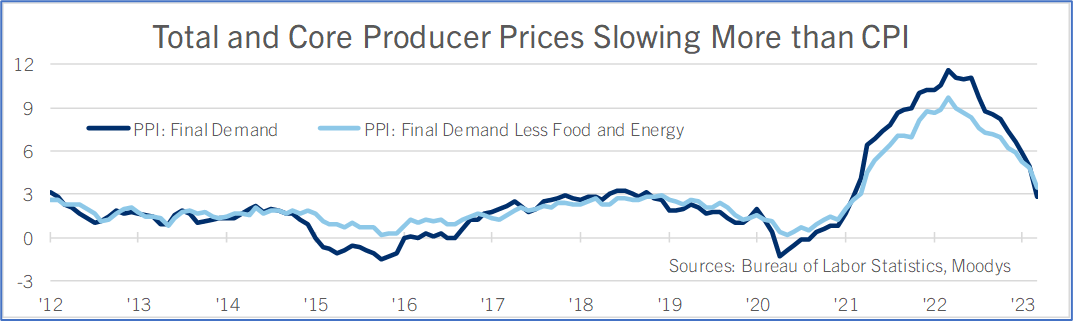

The Producer Price Index for Final Demand rose 0.2% in April after a 0.4% decline in March, revised from a 0.5% drop in the prior release. Both consensus and Comerica forecasted a 0.3% increase. From a year earlier, PPI final demand slowed to 2.3% from 2.7% in March (2.8% in the prior release), and was below the 2.4% consensus. The core PPI excluding foods, energy and trade services also rose 0.2% after an unrevised 0.1% increase in March and was likewise below the 0.3% consensus, which was also Comerica’s forecast. From a year earlier, core PPI rose 3.4%, matching the 3.4% consensus. In April, producer prices for foods fell 0.5%, energy prices rose 0.8%, and other goods rose 0.2%. Trade service charges rose 0.5%. Transportation and warehousing fell 1.7%; those prices have been flat or negative since July. Other services rose 0.4%.

Initial jobless claims rose 22,000 to 264,000 in the week ending May 6 and were the highest since late 2021. The consensus forecasted 245,000 and Comerica 240,000. Continued jobless claims rose 12,000 to 1,813,000 in the week ended April 29, below the 1,820,000 consensus and Comerica’s forecast of 1,850,000. From a year earlier, initial claims are up 54,000 and continued claims up 356,000. Jobless claims show a small margin of slack opening up in the labor market, in contrast to the monthly jobs report’s unemployment rate which was at a half-century low in April. Rising layoffs, falling job openings, and other weak leading indicators suggest unemployment is likely to rise over the next six months.

Inflation is cooling as fiscal stimulus programs like increased SNAP benefits and free school lunches lapse, tighter monetary policy shrinks the money supply, and the surge of energy and food prices after Russia’s invasion of Ukraine falls out of the year-over-year comparison. April’s slower PPI adds to evidence that consumer prices will also rise more slowly in the second half of 2023. Other reasons to expect slower inflation ahead include slower price increases reported by PMI surveys, and slower increases of non-shelter core service prices in yesterday’s CPI release. With the labor market becoming less tight as well, the Fed is more likely to begin reducing interest rates before the end of this year than to hold them unchanged into 2024.