Two Consecutive Quarters of Declining GDP in the First Half of 2022,

But Solid Job Growth Doesn’t Look Recessionary; Outlook Is Dicier, Though

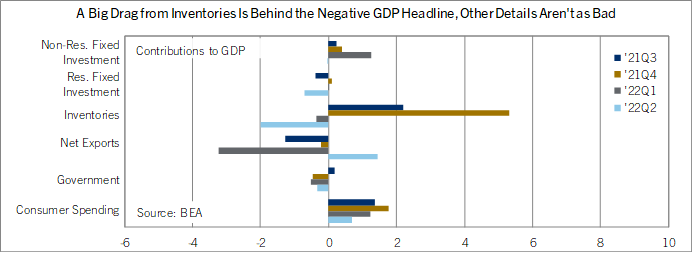

• Real GDP fell for a second consecutive quarter in the second quarter of 2022, but with solid job growth in the first half of the year, the economy didn’t look like it was in a recession.

• Businesses added to inventories more slowly, which like in the first quarter was a drag on GDP. Without this inventory effect, real GDP growth in the second quarter would have been positive.

• The second quarter saw big headwinds to growth from nondurable goods spending as consumers pulled back in the face of higher gas and food prices.

• Nonresidential and residential investment in structures was another big headwind due to continued supply and labor shortages and higher long-term interest rates.

• While it seems inaccurate to think of the first half of the year as a recession, the outlook for the second half and into 2023 is dicier.

Real GDP disappointed again in the second quarter, contracting at a 0.9% seasonally-adjusted annualized rate after a 1.6% decline in the first quarter. The consensus forecast had been for a 0.4% annualized increase. From a year earlier, real GDP growth slowed to 2.3% from 4.2% in the first quarter.

Consumer spending rose modestly in the second quarter and the handoff of spending from goods to services accelerated. Personal consumption expenditures rose 1.0% annualized, but spending on goods fell 4.4%, including a 2.6% drop in durable goods and a 5.5% drop in nondurable goods. Durable goods subtracted 0.2 percentage points from annualized GDP growth and nondurables 0.9 percentage points. Spending on services rose 4.1% annualized and added 1.8 percentage points to GDP growth. Americans drove less as gas prices surged, traded down on grocery purchases in the face of higher food prices, and bought fewer electronics, household appliances, and other durable goods after splurging in 2020 and 2021; auto supply chain issues also held back car sales in the second quarter. But in categories where the pandemic restrained spending in 2020 and 2021 like dining out, travel and entertainment, Americans made up for lost time despite eye-watering airfares and hotel room rates and long waits at restaurants.

Gross private domestic investment—spending by businesses--contracted at a 13.5% annualized rate in the second quarter, subtracting 2.7 percentage points from real GDP growth. Slower increases of inventories were most of the story, subtracting 2.0 percentage points from real GDP; they were a big drag on GDP in the first estimate for the first quarter, too, but that was later revised to show a smaller 0.4 percentage point headwind. Construction was a drag too, with residential fixed investment falling 14.0% and nonresidential fixed investment in structures falling 11.7%; residential subtracted 0.7 percentage points from GDP and structures 0.3 percentage points. Fixed investment on equipment pulled back 9.4% annualized after surging 44.1% in the first quarter, while spending on IP products rose 26.8%.

Government spending was a drag in the second quarter, too, subtracting 0.3 percentage points from annualized growth. Federal defense expenditures were up, but federal nondefense spending fell, as did state and local spending. As a share of GDP, federal, state, and local consumption and investment have been the lowest since the 1950s over the last three quarters as rising private wages dissuaded workers from taking public-sector jobs (think of all the city pools and summer camps that are running on reduced schedules because they can’t staff up). As a reminder, government outlays on Social Security, Medicare, Medicaid, and other social programs generally don’t show up as government expenditures in the GDP accounts; outlays from those programs generally show up as personal consumption expenditures in the GDP accounts. And the trade deficit narrowed, adding 1.4 percentage points to GDP growth. Exports grew solidly, while goods imports edged down as consumers, retailers, and wholesalers bought fewer consumer goods.

The GDP deflator—the price of domestically-produced goods and services—rose 8.7% annualized in the second quarter, up from an 8.2% increase in the first. Prices of investment in residential and nonresidential structures, as well as goods and services purchased by state and local governments, rose at double-digit annualized rates. Before adjusting for inflation, GDP rose 7.8% annualized in the second quarter or 9.3% in year-ago terms.

Despite two consecutive quarters of declining real GDP, it seems inaccurate to consider the first half of the year a recession. There’s a complicated formal definition of recession, but it’s mostly captured by the old adage, “recession is when your neighbor loses his job, depression is when you lose yours.” A recession unfolds when activity falls in one part of the economy, causing layoffs which make households cut back on spending, forcing broader job cuts that ripple across the economy. And Americans didn’t lose jobs in the first half of the year. On the contrary, the U.S. economy added nearly half a million jobs per month on average, including 375,000 per month in the second quarter. The vicious cycle that fuels a recession was absent in the first half of 2022.

That said, the outlook is dicier. Leading indicators of the business cycle keep getting worse: The Conference Board’s Leading Economic Index is falling, the yield curve is inverted, unemployment insurance claims are rising, and business and consumer confidence falling. Big stock market declines like the one earlier this year typically precede recessions, too. The U.S. economy still receives support from savings built up during the pandemic (yes, mostly held by upper-income households, but they spend, too) and by a huge backlog of job openings that many employers still want to fill despite recession fears. These supports could help the U.S. dodge recession despite headwinds from tightening monetary and fiscal policies, high food and gas prices, an extremely strong dollar that will slow exports, and weak sentiment toward the economy. But it’s a close call. Another negative shock like an energy crisis in Europe this winter would be enough to push the U.S. into a recession.