Preview of the Week Ahead

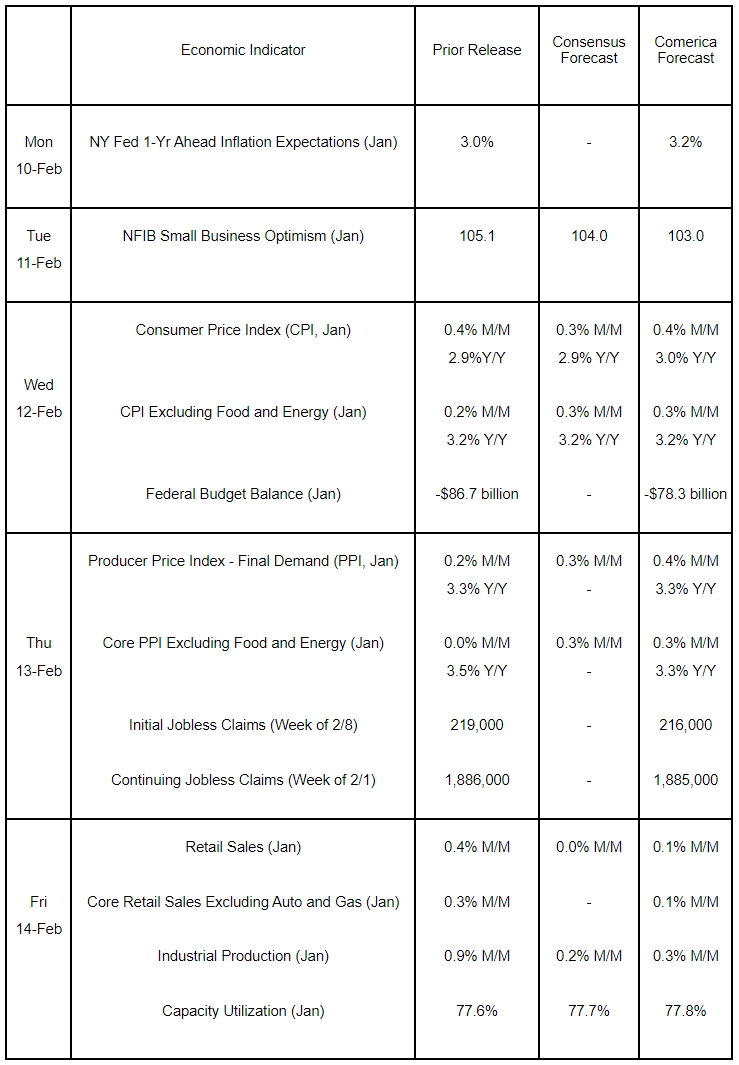

Inflation data dominates the economic calendar this week. Inflation as measured by the consumer and producer price indices is expected to have accelerated in January on a sharp increase in energy prices. Core consumer and producer price indices, which exclude volatile energy and food components, probably remained elevated. In separately-compiled consumer surveys, inflation expectations likely tracked gas prices higher.

Bad weather likely weighed heavily on retail sales and mining in the industrial production report, offset by a jump in utilities output. Industrial production and capacity utilization, overall, are expected to have edged higher in January. The federal government’s budgetary balance likely remained in the red at 2024 year-end. Small business optimism likely took a breather following two consecutive months of sharp increases.

The Week in Review

The labor market slowed at the turn of the year. 143,000 jobs were added in January in line with Comerica Economics’ forecasts. The prior two months’ jobs growth was revised up by a combined 100,000, for an average job increase of 284,000 per month. The Bureau of Labor Statistics did not see an impact of the LA wildfires or winter weather on the jobs report, but the report, walks, talks, and quacks like a report for a month hit by a natural disaster. The unemployment rate eased a notch to 4.0% as the number of people out of the workforce rose. Hours worked declined broadly across industries, pushing the average workweek down to the lowest since March 2020 (34.1 hours), and average hourly earnings spiked 0.5% as employment fell in industries with many low-wage hourly workers, like leisure and hospitality and temp help services. Big benchmark revisions also complicated the interpretation of the January report: The December 2024 level of employment in the payroll survey was revised down by 610,000, while the level of employment in the household survey was revised up 2.0 million.

Job openings unexpectedly plunged by 556,000 to 7.6 million in December and were well below the 8.0 million consensus. Vacancies fell notably in professional and business services, down 225,000, private education and health services, down 194,000, and financial activities, down 166,000.

The trade deficit widened by 17.0% to $918 billion in 2024. A 14.0% increase in the goods deficit to $1.212 trillion caused the overall deterioration and was partially offset by a $293 billion services surplus, which grew by 5.4% last year. The $253 billion trade deficit with China was the largest among America’s biggest trade partners and was followed by $172 and $149 billion shortfalls with Mexico and the European Union, respectively. The trade deficit with Canada was much smaller at $38 billion.

The ISM Services PMI retreated to 52.8 in January from 54.0 in the prior month. As expected, many respondents reported negative impacts of adverse weather on their businesses. Service-providing business activity (production) and new orders both fell. Employment increased, while prices paid for inputs rose at a slower pace. Many respondents were reported to have prepared for potential tariffs or had concerns about them, like in December. However, respondents made little comment about direct impacts to their business.

For a PDF version of this publication, click here: Comerica Economic Weekly, February 10, 2025(PDF, 135 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.