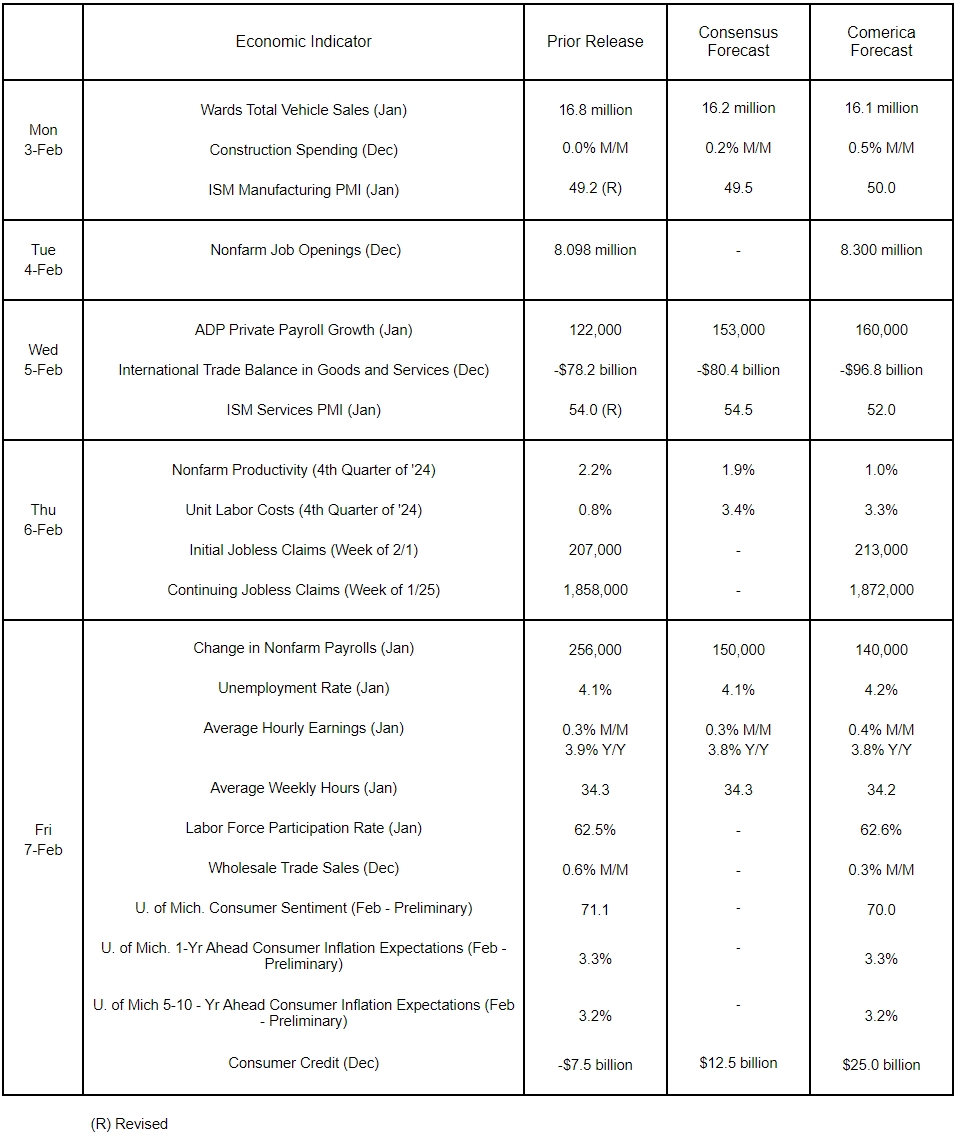

Preview of the Week Ahead

Adverse weather likely impacted the labor market last month, resulting in below trend growth in hiring and hours worked. Weather’s negative effect will probably show up in the ISM Services PMI as well, as service providers are more affected by inclement weather than manufacturers. On the back of strong post-election business optimism, employers are anticipated to have increased job postings. The very sharp deterioration in the goods trade balance in December will probably lead to a considerable widening of the overall trade deficit as well. Consumer spending rose very sharply in December, likely fueled in part by credit. Hence, consumer credit is anticipated to have risen sharply in the final month of the year. Soaring housing starts in December likely translated into a solid increase in construction spending.

The Week in Review

As expected, the Federal Open Market Committee (FOMC) unanimously held the fed funds rate steady at a range of 4.25% to 4.50% and did not alter the pace of its balance sheet reduction program. The Committee judged labor market conditions to be “solid.” Acknowledging recent disappointing inflation developments, they removed “Inflation has made progress toward the Committee’s 2 percent objective” from their statement and concluded it remained “somewhat elevated.” Chair Powell repeatedly emphasized the FOMC was in “no hurry” to ease rates at the interest rate press conference.

Economic growth in the fourth quarter slowed to 2.3% annualized from 3.1% in the third, but the headline figure belies underlying strength. Consumer spending rose by a rock-solid 4.2% annualized. Ending two consecutive quarters of declines, residential investment rose by 5.3%. Government spending was up 2.5%. Net exports made a marginal positive contribution. Overall economic growth in the fourth quarter was dragged down by inventory destocking, which subtracted 0.9 percentage points from growth. Business investment also subtracted from growth, but the impact was modest. Economy-wide inflation rose to 2.2% annualized from 1.9% in the third quarter. Led by stickier services prices, the Personal Consumption Expenditures (PCE) Price Index—the Fed’s preferred inflation barometer—accelerated to 2.3% annualized in the fourth quarter from 1.5% annualized in the third.

The American economy grew by 2.8% for the full year of 2024, a tad slower than it did in 2023. Consumer spending was the main pillar of growth, accounting for two-thirds of the economic expansion. Business investment and government spending also contributed notably to growth in 2024. A surge in imports made the external sector a headwind to growth. Economy-wide prices rose by 2.4% last year, an improvement from the 3.6% increase in 2023. Inflation as measured by the PCE Price Index, up 2.5% in 2024, was also appreciably lower than the 3.8% recorded in the prior year.

Auto sales rose to an annualized rate of 16.8 million units in December, the highest in nearly three-and-a-half years, leading to a sizeable 1.2% drop in inventories at auto wholesale merchandisers. Consumers likely pulled forward purchases into December in case the Trump administration phases out electric vehicle subsidies, or higher tariffs raise the price of vehicles imported from Canada and Mexico.

For a PDF version of this publication, click here: Comerica Economic Weekly, February 3, 2025(PDF, 154 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.