Preview of the Week Ahead

Our thoughts are with the many people affected by the terrible fires in Southern California.

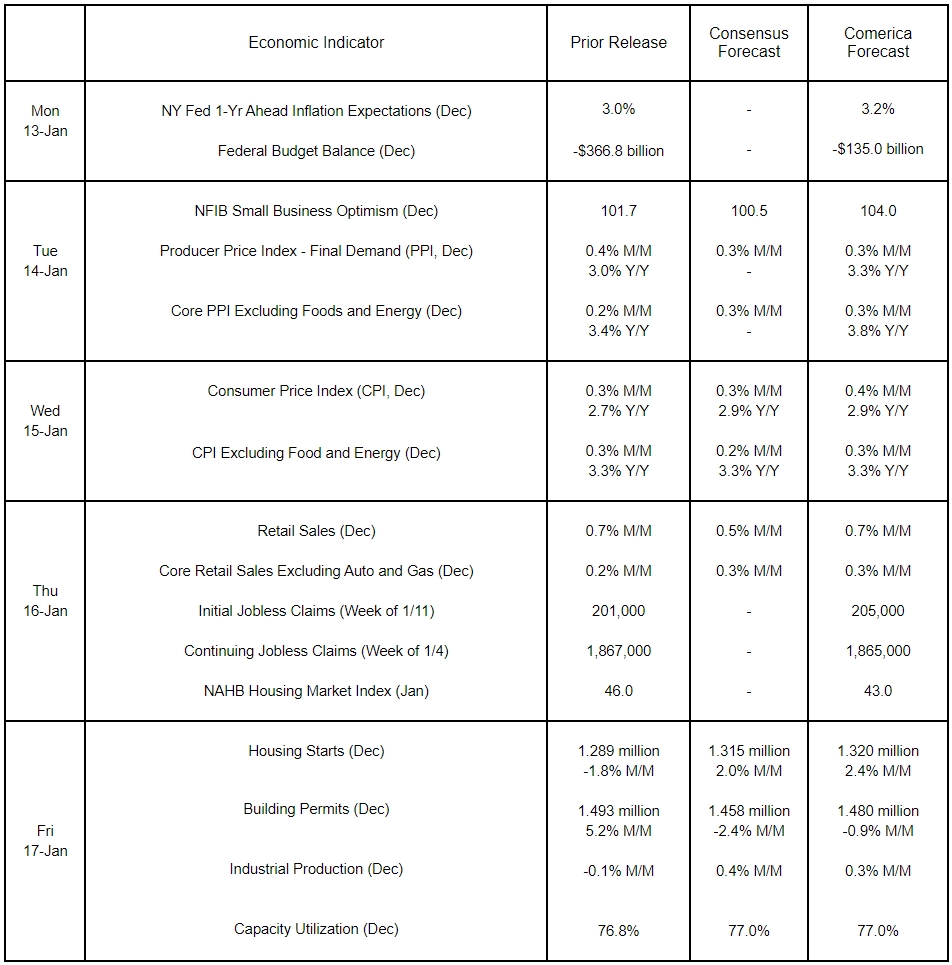

Inflation reports will dominate this week’s economic calendar. Driven by high energy prices, the Consumer Price Index (CPI) probably accelerated on a monthly and annual basis in December, while core CPI likely matched November’s pace. High energy prices likely pushed up producer prices as well. The New York Fed will probably report year-ahead household inflation expectations rose last month.

Household spending likely rose sharply in the final month of the shopping season, ending the year on a strong note. Housing data are likely to be mixed: Building permits probably fell in December, while housing starts likely rebounded after November’s slump. In another sign of stronger animal spirits post-election, small business optimism likely rose further in December.

The Week in Review

Nonfarm payrolls rose a stronger-than-expected 256,000 in December, with jobs in October and November revised down a net 8,000. The unemployment rate pulled back to 4.1% from 4.2% in November. Temporary jobs rose a second consecutive month, a positive leading indicator for broader hiring. Also, national temperatures averaged 7.3 degrees above average in December, boosting outdoor employment in construction, hospitality, and entertainment. Average hourly earnings rose 0.3% on the month and 3.9% on the year, and have outpaced inflation since mid-2023. The LA wildfires will weigh on the January jobs report, as will annual revisions that are likely to reflect high immigration in 2024 translating into higher labor market participation and a higher unemployment rate.

Job openings rose more than expected to 8.098 million in November from an upwardly-revised 7.839 million in the prior month and were handsomely above the 7.745 million consensus forecast, another sign that hiring intentions are firming. November’s 259,000 increase was almost exclusively in the private sector, concentrated in finance and insurance and professional and business services. Continuing a longer downdraft in public sector vacancies, government job postings rose a paltry 3,000.

The minutes of the Federal Open Market Committee’s (FOMC) December meeting clarified the committee’s thinking on inflation and the future path of monetary policy. “Almost all participants judged that upside risks to inflation had increased,” they note, attributing the change to “recent stronger-than-expected readings on inflation and the likely effects of potential changes in trade and immigration policy.” Consequently, policymakers foresee taking “a careful approach” to monetary policy adjustments going forward.

The ISM Services PMI rose by 2.0 to 54.1 in December and exceeded the 53.5 consensus. Service-providing business activity soared, indicating the economy ended the year on a strong note, while new orders rose faster than in November. Prices paid by service-providing businesses rose at the fastest pace in nearly two years, a major negative of the report.

For a PDF version of this publication, click here: Comerica Economic Weekly, January 13, 2025(PDF, 146 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.