Preview of the Week Ahead

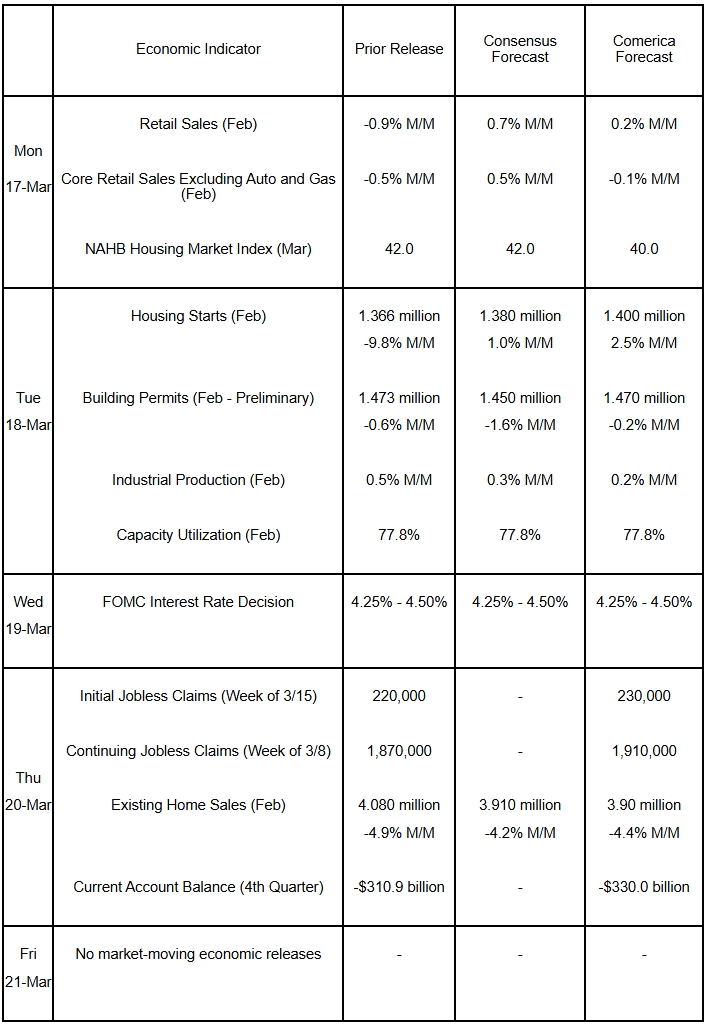

The FOMC’s decision is the week’s main economic event. While no changes are expected, markets will closely scrutinize policymakers’ economic and interest forecasts and Chair Powell’s comments for clues about the future path of monetary policy. The FOMC could also unveil plans to pause or end its balance sheet reduction program (a.k.a. “Quantitative Tightening” or QT). Retail sales likely bounced back in February from the sharp weather-affected slump in January. Homebuilder sentiment probably eased further, translating into another negative print of building permits. Housing starts, however, are expected to have rebounded as the weather improved. The decline in pending home sales to a record low in January likely means existing home sales fell sharply again last month.

The Week in Review

Inflation eased in February. The Consumer Price Index (CPI) and core CPI, which excludes volatile food and energy components, rose by 0.2% last month and were up 2.8% and 3.1%, respectively, from a year earlier; all increases were below the consensus forecasts. Shelter again contributed the most to inflation, accounting for half of February’s increase. Electricity and utility (piped) gas service prices rose sharply last month, while gasoline prices fell. Food prices were mixed: Prices of food at home, mostly groceries, were unchanged in February as declines in many categories offset surging egg prices, while prices of food consumed away from home, largely prices charged at restaurants, rose notably. Services excluding shelter and energy services rose by modest 0.2% in February, easing the annual comparison to 3.9%, the lowest since October 2023. Motor vehicle insurance costs—a major contributor to inflation over the past three years—rose a moderate 0.3%. Airline fares tumbled by 4.0% after posting hefty increases at the turn of the year. The Producer Price Index (PPI) was unchanged in February, resulting in annual producer inflation pulling back to 3.2% in February from 3.7% in January. Core PPI fell 0.1% and pushed the annual comparison down to 3.4% from 3.8%. Wholesale egg prices more than doubled, while energy prices fell. Wholesalers and retailers sharply reduced their margins, resulting in a 0.2% drop in services prices.

The spending cuts announced by DOGE this year are not showing up in the fiscal data, at least not so far. The federal government’s deficit widened to $307 billion in February from $129 billion in January, ballooning the fiscal year-to-date shortfall to $1.15 trillion. Revenues rose by 2.0% in the first five months of the fiscal year from the same period of the prior year, while expenditures soared by 13%. Personal income tax receipt growth, up 3% year-to-date, has been lackluster, and corporate tax receipts are down 18%. The government’s five largest categories of expenditures are all notably higher: Social Security is up 6%; Medicare up 37%; Defense up 10%; Health (Mostly Medicaid) up 8.0%; and net interest up 13%.

Job openings rose to 7.740 million in January from a downwardly revised 7.508 million vacancies in December. Job listings rose across most private sector industries and were notably higher in retail trade and in the financial sector. Federal government job openings fell a slight 3,000. Annual benchmark revisions scaled back vacancies in 2024, on average, by 264,000 per month. The hires rate was unchanged at a subdued level but quits jumped to the highest since July.

For a PDF version of this publication, click here: Comerica Economic Weekly, March 17, 2025(PDF, 140 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.