Preview of the Week Ahead

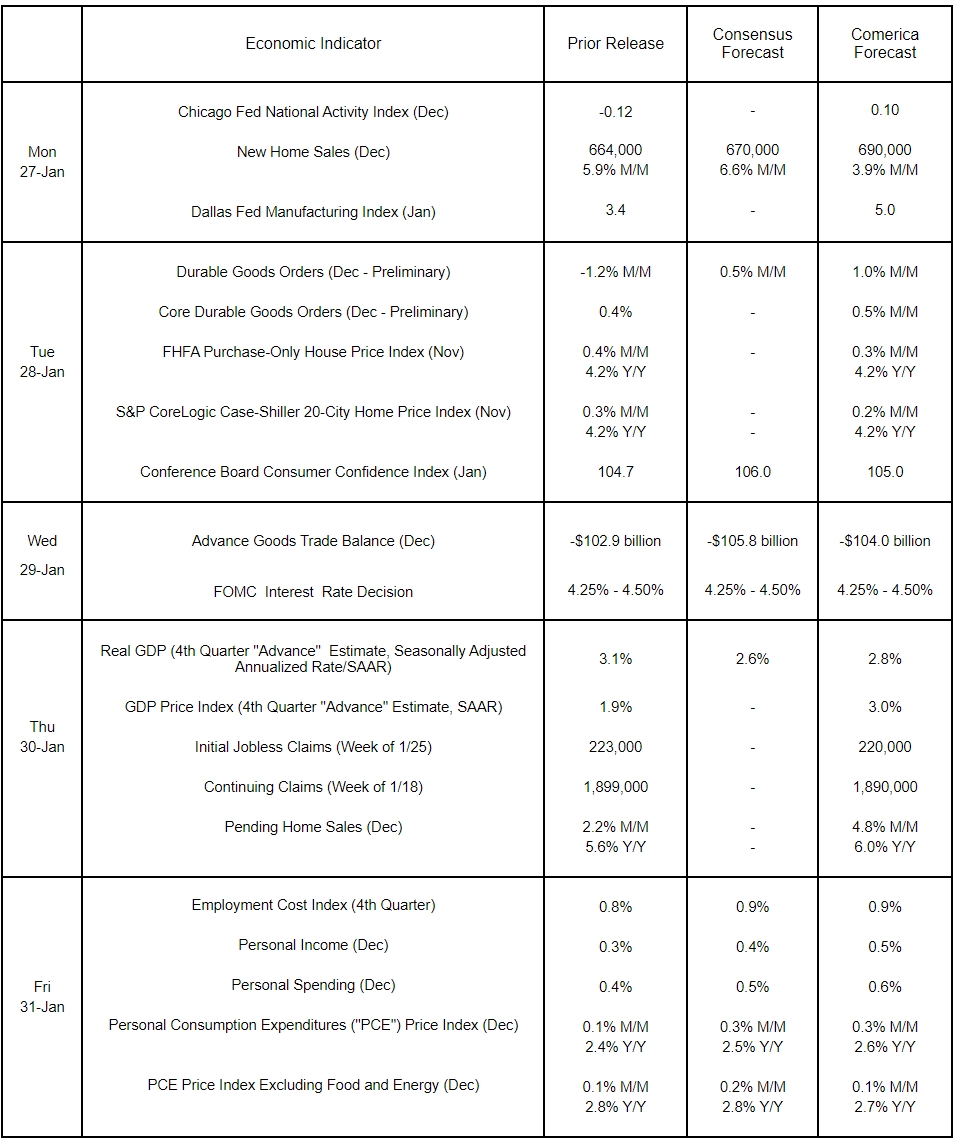

Monetary policymakers are expected to hold unchanged both policy rates and the pace of balance sheet reduction at Wednesday’s Fed decision. Financial markets will be keen to hear how the Trump administration’s policies are changing Fed’s outlook for growth and inflation, following the wave of executive orders announced after the inauguration.

Markets will also get the first estimate of fourth quarter economic growth as well as last year’s annual average. The economy is expected to have ended the year solidly, with consumer spending particularly strong. The gross domestic product price index, the economywide gauge of prices, likely accelerated last quarter on higher energy prices. Personal incomes and spending probably rose further in December. Headline and core personal consumption expenditures (PCE) price indices—the Fed’s preferred inflation barometers—likely ended the year a bit above the Fed’s 2% target and have been little changed for the last six months.

Continuing a multi-month cooling trend, house prices likely rose at a slower pace in November. The Employment Cost Index, a comprehensive quarterly gauge of employers’ costs of wages and benefits, probably edged higher last quarter in line with higher wage inflation. Consumer confidence likely rose in January after tumbling unexpectedly in December.

The Week in Review

S&P Global’s Composite PMI eased to 52.4 in the January flash release from 55.4 in December. The underlying details were, however, more positive. The manufacturing sector expanded for the first time in seven months. The services sector expanded at a slower pace, but the slowdown is likely temporary as service providers reported “especially adverse weather as a dampener of activity in some companies.” Manufacturers reported the first increase of new orders in several months, while service providers’ new workflows remained “robust.” Led by a surge in services hiring, employment rose at the fastest rate in two-and-a-half-years. These positives were partially offset by more inflationary pressures, with both manufacturers and service providers reporting the highest increase in input costs and selling prices in four months.

Existing home sales rose by 2.2% to 4.24 million units in December and were up 9.3% from a year earlier. Listings were equivalent to 3.3 months of supply at last month’s pace of sales; months’ supply is about back to pre-pandemic levels, with both sales and listing down sharply since then. The median sales price of an existing home held steady at $404,400 for the second consecutive month. Compared to December 2024, the median sales price is up $23,000 or 6.0%, which the National Association of Realtors—who publish the report—said was “partly due to the upper-end market’s relative better performance.”

The University of Michigan’s Index of Consumer Sentiment was revised down to 71.1 in the January final release from a 73.2 preliminary reading. Year-ahead and long-term inflation expectations are up from before the election, with respondents attributing the increase to “beliefs about anticipated policies like tariffs."

For a PDF version of this publication, click here: Comerica Economic Weekly, January 27, 2025(PDF, 161 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.