Defensive Positioning Pays Off As Policy Upheaval Roils Markets

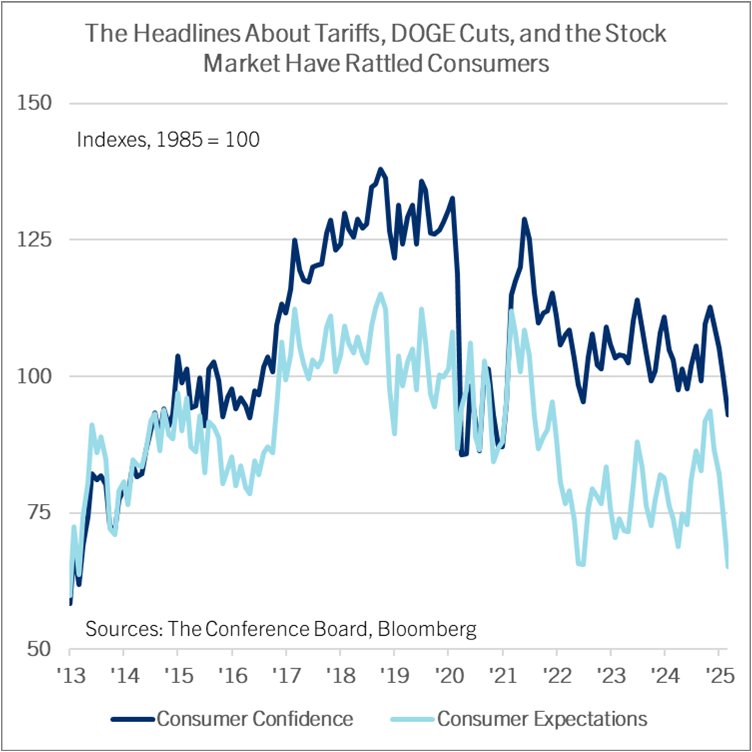

The economy kicked off 2025 on the wrong foot, with early indicators pointing to an ugly GDP report for the first quarter when the advance estimate is published April 30. A lot of the quarter’s headwinds look temporary. The hit to activity during the LA wildfires, disruptions from winter storms, and the surge of imports as businesses front-ran higher tariffs should fade quickly. But other drags on growth could persist. The DOGE cuts to government headcount and spending are likely to weigh on employment and GDP from education and social assistance programs this year. And consumer sentiment has soured on headlines about DOGE layoffs, tariffs, and the stock market selloff. Consumer spending held up (despite dour sentiment) during the high inflation of 2022 and 2023. But unlike then, the latest data show consumers are increasingly worrying about losing jobs, which could cause more cautious discretionary spending and delays to big-ticket purchases of houses, autos, or appliances.

In addition, tariff hikes and the prospect of more tariffs coming are rattling businesses. Higher tariffs will create winners and losers in corporate America. Manufacturers who sell domestically can charge higher prices as tariffs squeeze the foreign competition, but will may see higher input costs, too, for the same reason. The cost of business for service-providing companies will rise, but without a tariff boost to sales prices, squeezing margins. And the largest American companies with extensive overseas operations will likely bear the brunt of foreign tariffs and other retaliation.

With growth coming in weaker-than-expected on the one hand, but tariffs likely to raise consumer prices on the other hand, the outlook for the Fed is largely unchanged from the start of the year. The central bank is likely to cut rates modestly in 2025, but by less than in 2024. Even if growth slows, the Fed is likely to look through an immediate soft patch, since the White House is explicitly positioning spending cuts and tariff revenues as measures to pay for tax cuts next year. The combined effects of 2025’s spending cuts and higher tariffs and 2026’s tax cuts could be a wash, holding the fiscal deficit at 6% to 7% of GDP. The Fed may see that fiscal stance as justification to keep their foot on the brake.

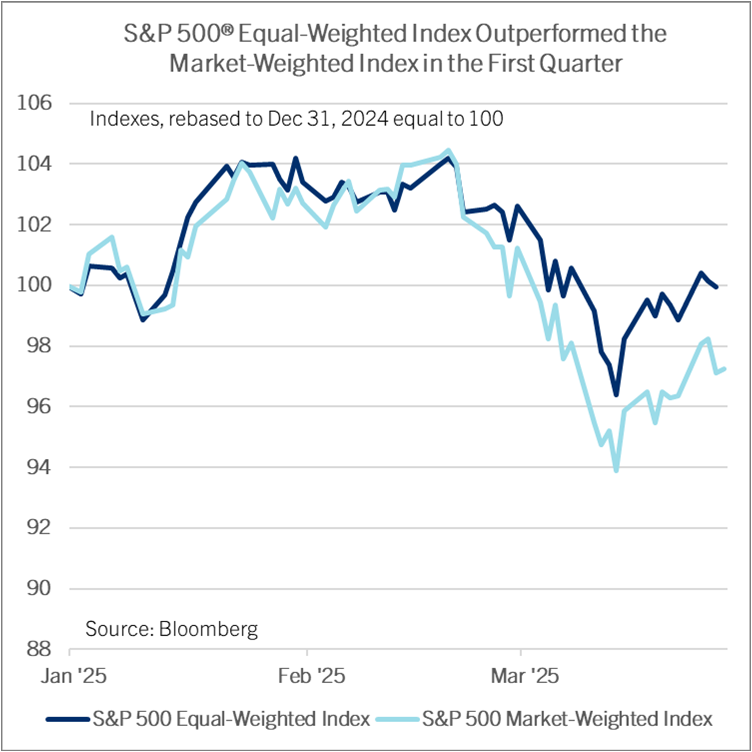

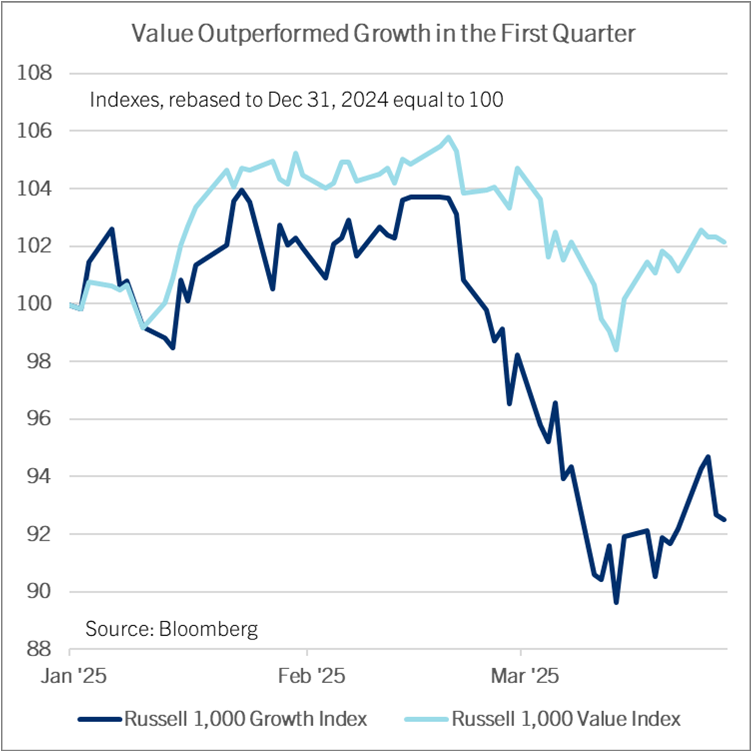

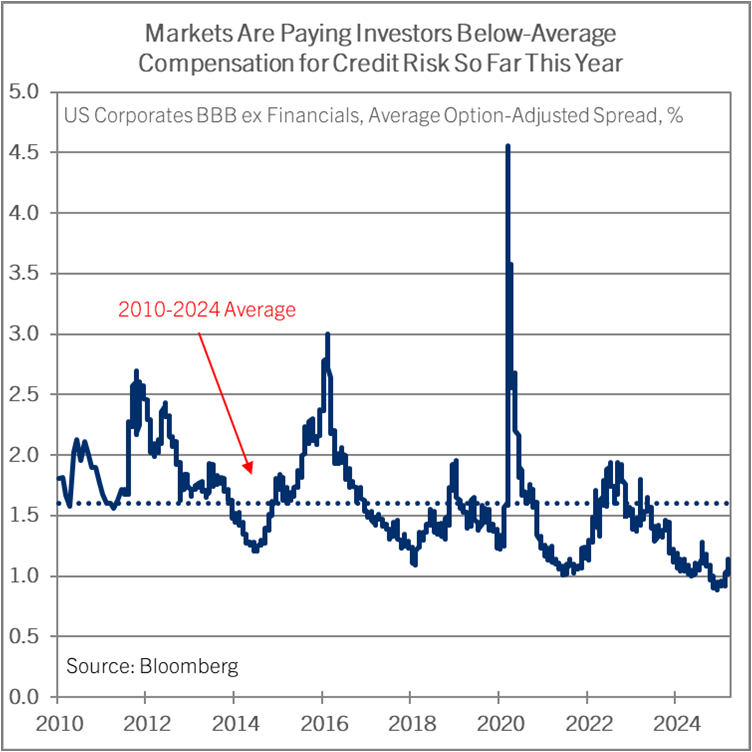

Regarding markets, the defensive allocation tactics proposed in Comerica’s January 2025 Market Outlook largely performed as hoped in the first quarter. Value stocks outperformed growth stocks, the S&P500 Equal Weighted Index outperformed the S&P500 Market Weighted Index, the Fed held interest rates unchanged as expected, and credit spreads widening slightly to approach historically normal levels. In our opinion, these allocations continue to offer attractive opportunities to limit risk in investment portfolios, and to also limit exposure to sectors of the financial markets where valuations appear the most overstretched.

Given the weak start to the year, Comerica is modestly lowering our year-end S&P 500 forecast to 6,250 from 6,300 in January. With the expectation for weak GDP growth in the first quarter, recession risk looks higher than in January, but still below 50-50. Financial and economic sentiment are likely to improve in the second half of 2025 as the market narrative shifts from 2025’s higher tariffs and spending cuts to 2026’s tax cuts.

2025 Investment Allocation Ideas

Equities:

- Favor quality stocks: At this stage of the cycle, companies with strong balances sheets have historically performed well, and currently trade at reasonable prices.

- If indexing, consider equal-weighted indexes over market-weighted indexes: Even after the first quarter’s repricing of risk, the equal-weighted index trades at a 20% discount to its market-weighted peer.

- Favor defensive sectors in your asset allocation: With obvious downside risks to global growth and valuations high, defensive sectors can outperform cyclicals, even without a recession.

Bonds:

- Monitor duration positioning within fixed income: With short-term interest rates down from 2024, the reinvestment yield on money market and short-term bonds is resetting lower. A modest duration / maturity profile can protect a portfolio’s yields.

- Extend bond portfolio duration: While credit spreads widened slightly in the first quarter, they are still narrow in a longer-term historical comparison. With the yield curve steepening, extending the duration of bond portfolios looks attractive compared with taking on excessive credit risk.

- Investment grade core fixed-income: Treasuries, municipal bonds and corporate debt all look attractive for yield over 5%. Spreads are relatively tight, but are well supported by low downgrade risks and high credit quality.

- Low equity risk premiums favor bonds: Even after the modest market correction of the first quarter, equity valuations are less attractive than those of bonds. Valuation is an imperfect metric to predict near-term returns, but is a useful input to a broader evaluation of portfolio risk management.

Real Assets:

- Public infrastructure and energy appear poised to perform: U.S. energy demand is growing as AI and blockchain adoption spread in the economy. Proposed supportive regulations for energy to fuel the AI boom could provide incremental upside to the sector.

- U.S. private real estate investments are well positioned: Returns of private real estate investments slowed in 2024 due to the rapid rise in interest rates. The Fed’s recent rate reductions reduce the cost of borrowing and expand net operating income for private real estate investors. This could unlock pent-up demand and dealmaking, in our view.

- Macro/geopolitical risks magnify the value of diversifiers: Macroeconomic risks, including wars in the Middle East and Ukraine, trade conflicts, high equity valuations, and the threat of resurgent inflation make diversifiers like gold, other metals, and commodities more compelling.

IMPORTANT DISCLOSURES

Comerica Wealth Management consists of various divisions and affiliates of Comerica Bank, including Comerica Bank & Trust, N.A. Inc. and Comerica Insurance Services, Inc. and its affiliated insurance agencies.

Comerica Bank and its affiliates do not provide tax or legal advice. Please consult with your tax and legal advisors regarding your specific situation.

Non-deposit Investment products offered by Comerica and its affiliates are not insured by the FDIC, are not deposits or other obligations of or guaranteed by Comerica Bank or any of its affiliates, and are subject to investment risks, including possible loss of the principal invested.

Unless otherwise noted, all statistics herein obtained from Bloomberg L.P.

This is not a complete analysis of every material fact regarding any company, industry or security. The information and materials herein have been obtained from sources we consider to be reliable, but Comerica Wealth Management does not warrant, or guarantee, its completeness or accuracy. Materials prepared by Comerica Wealth Management personnel are based on public information. Facts and views presented in this material have not been reviewed by, and may not reflect information known to, professionals in other business areas of Comerica Wealth Management, including investment banking personnel.

The views expressed are those of the author at the time of writing and are subject to change without notice. We do not assume any liability for losses that may result from the reliance by any person upon any such information or opinions. This material has been distributed for general educational/informational purposes only and should not be considered as investment advice or a recommendation for any particular security, strategy or investment product, or as personalized investment advice.

Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future returns. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The investments and strategies discussed herein may not be suitable for all clients.

The S&P 500® Index, S&P MidCap 400 Index®, S&P SmallCap 600 Index® and Dow Jones Wilshire 500® (collectively, “S&P® Indices”) are products of S&P Dow Jones Indices, LLC or its affiliates (“SPDJI”) and Standard & Poor’s Financial Services, LLC and has been licensed for use by Comerica Bank, on behalf of itself and its Affiliates. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services, LLC (“S&P”) and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings, LLC (“Dow Jones”). The S&P 500®® Index Composite is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, or their respective affiliates and none of such parties make any representation regarding the advisability of investing in such product nor do they have any liability for any errors, omissions, or interruptions of the S&P Indices.

NEITHER S&P DOW JONES INDICES NOR STANDARD & POOR’S FINANCIAL SERVICES, LLC GUARANTEES THE ADEQUACY, ACCURACY, TIMELINESS AND/OR THE COMPLETENESS OF THE WAM STRATEGIES OR ANY DATA RELATED THERETO OR ANY COMMUNICATION, INCLUDING BUT NOT LIMITED TO, ORAL OR WRITTEN COMMUNCATION (INCLUDING ELECTRONIC COMMUNICATIONS) WITH RESPECT THERETO. S&P DOW JONES INDICES AND STANDARD & POOR’S FINANCIAL SERVICES, LLC SHALL NOT BE SUBJECT TO ANY DAMAGES OR LIABILITY FOR ANY ERRORS, OMISSIONS, OR DELAYS THEREIN. S&P DOW JONES INDICES AND STANDARD & POOR’S FINANCIAL SERVICES, LLC MAKE NO EXPRESS OR IMPLIED WARRANTIES, AND EXPRESSLY DISCLAIM ALL WARRANTIES, OR MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE OR AS TO RESULTS TO BE OBTAINED BY COMERICA AND ITS AFFILIATES, OR ANY OTHER PERSON OR ENTITY FROM THE USE OF THE S&P INDICES OR WITH RESPECT TO ANY DATA RELATED THERETO. WITHOUT LIMITING ANY OF THE FOREGOING, IN NO EVENT WHATSOEVER SHALL S&P DOW JONES INDICES OR STANDARD & POOR’S FINANCIAL SERVICES, LLC BE LIABLE FOR ANY INDIRECT, SPECIAL, INCIDENTAL, PUNITIVE, OR CONSEQUENTIAL DAMAGES INCLUDING BUT NOT LIMITED TO, LOSS OF PROFITS, TRADING LOSSES, LOST TIME OR GOODWILL, EVEN IF THEY HAVE BEEN ADVISED OF THE POSSIBILITY OF SUCH DAMAGES, WHETHER IN CONTRACT, TORT, STRICT LIABILITY, OR OTHERWISE. THERE ARE NO THIRD-PARTY BENEFICIARIES OF ANY AGREEMENTS OR ARRANGEMENTS BETWEEN S&P DOW JONES INDICES AND COMERICA AND ITS AFFILIATES, OTHER THAN THE LICENSORS OF S&P DOW JONES INDICES.

“Russell 2000® Index and Russell 3000® Index” are trademarks of Russell Investments, licensed for use by Comerica Bank. The source of all returns is Russell Investments. Further redistribution of information is strictly prohibited.

MSCI EAFE® is a trademark of Morgan Stanley Capital International, Inc. (“MSCI”). Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

FTSE International Limited (“FTSE”) © FTSE 2016. FTSE® is a trademark of London Stock Exchange Plc and The Financial Times Limited and is used by FTSE under license. All rights in the FTSE Indices vest in FTSE and/or its licensors. Neither FTSE nor its licensors accept any liability for any errors or omissions in the FTSE Indices or underlying data.comerica.com/insights