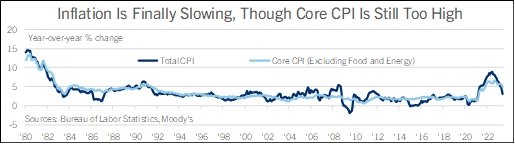

The Fever Is Breaking: CPI Slowest Since Early 2021, Though Core CPI Is Still High

• Total and core CPI were cooler than expected in June, and favorable base comparisons delivered a big slowdown in the year-over-year increase.

• The June CPI shows inflation is moving toward the Fed’s target, but they will probably still raise rates later this month after the June jobs report showed wage increases still running hot.

• The July hike is probably the Fed’s last of this cycle, although they could make one more before year-end if inflation or wage growth surprise to the upside between now and then.

The CPI rose 0.2% in June, below the 0.3% forecasted by Comerica and the consensus of private forecasters. Food prices rose a modest 0.1%, while energy prices rose 0.6% on a 1.0% increase in gasoline prices. The core CPI excluding food and energy rose 0.2%, down from 0.4% in May and below the 0.3% consensus forecast; this was the smallest increase of the core CPI since August 2021. New vehicle prices were unchanged on the month after declines in the prior two months, while used car prices fell 0.5% after big increases in April and May. Shelter costs rose 0.4% on the month, with rents up 0.5% and owners’ equivalent rents of primary residence up 0.4%. June tied April for the smallest monthly increase in shelter costs since January 2022.

In year-ago terms, CPI slowed to 3.0% from 4.0% and was the slowest since March 2021. Core CPI slowed to 4.8% in year-ago terms from 5.3% in May and was the slowest since October 2021. “Supercore” CPI Services Excluding Energy and Shelter rose just 0.1% on the month and slowed to 3.9% in year-ago terms from 4.6%—the Fed is closely watching this measure of inflation’s underlying trend. A big part of June’s slower CPI is due to favorable base comparisons. Since prices were surging last summer, a moderate monthly increase in mid-2023 translates into a much lower year-over-year increase. But the CPI is slowing over other time horizons, too. On a three-month annualized basis, total CPI rose 2.7% in June, while core CPI rose 4.1%. With slower CPI, real average hourly earnings of private-sector workers rose a decent 1.2% on the year in June. Wage growth has outpaced inflation since gas prices peaked last summer, a tailwind to consumer spending going forward.

The Fed will see the June CPI report as progress toward getting inflation back to their target, but is still very likely to raise their policy rate a quarter percent at the July 26 decision. They would rather tighten too much and slow the economy more than necessary than tighten too little and risk that inflation picks up again when the economy regains momentum. Average hourly earnings rose a hot 4.4% on the year in June; the Fed wants wage growth to moderate to be more confident that slower inflation will be the trend. The July rate hike will probably be the Fed’s last of this cycle, but they could raise their target another quarter percent before year-end if job growth, wage growth, or inflation surprise to the upside in the next few months.