Fed Sees No ‘Hurry’ For Further Rate Cuts

Comerica Revises Forecast To Have One Quarter Percent Rate Cut In 2025

• The Fed held their target rate unchanged at the January decision, matching Comerica’s forecast and market expectations.

• The Fed’s policy statement shows they see inflation as no longer an emergency, but not a solved problem, either. They are also less worried about the job market.

• Chair Powell signaled that the Fed could hold interest rates at current levels for a meaningful period.

• Comerica is revising our interest rate forecast to see a single quarter percentage point rate cut in 2025 around mid-year, when the Fed ends the run-off of their bond holdings (a.k.a. “Quantitative Tightening”).

As widely expected, the Fed held the target for the federal funds rate unchanged at a range of 4.25% to 4.50% at the January 29th decision. The Fed also continues to reduce the size of their balance sheet (a.k.a. “Quantitative Tightening” or QT) at an unchanged pace, allowing up to $25 billion in Treasuries and $35 billion in mortgage-backed securities to run off each month. The January decision was unanimous. There were no updated economic projections (“Dot Plot”) at the meeting. The Fed publishes Dot Plots quarterly and will release the next set in March.

In the policy statement, the Fed saw the job market as a little stronger than they did in their December statement, but were less upbeat about inflation. Where the prior statement said, “Since earlier in the year, labor market conditions have generally eased, and the unemployment rate has moved up but remains low,” the current statement reads, “The unemployment rate has stabilized at a low level in recent months, and labor market conditions remain solid.” The unemployment rate’s increase through mid-2024 triggered the “Sahm Rule,” former Fed economist Claudia Sahm’s observation that when the unemployment rate’s three-month moving average rises half a percent or more from its twelve-month low, the economy has historically been in a recession. The unemployment rate’s increase last year was a big part of why the Fed cut interest rates a full percentage point between September and December. But luckily, 2024 ended up an exception to the Sahm Rule, with strong real GDP growth that put recession fears to rest.

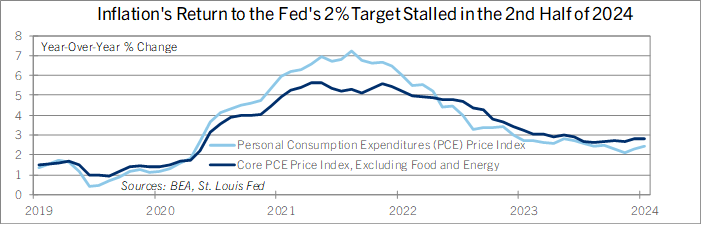

Regarding inflation, the statement read, “Inflation remains somewhat elevated,” a change from the prior statement which said that “Inflation has made progress toward the Committee’s 2 percent objective but remains somewhat elevated.” Inflation’s return to the Fed’s 2% target stalled in mid-2024, with core PCE inflation holding little changed between 2.5% and 3.0% since then (See chart). Inflation is no longer an emergency like it was in late 2021 or in 2022, but it isn’t a solved problem, either.

In the press conference following the decision, Chair Powell said that for the Fed to cut rates further, they would want to see further progress on inflation (Or alternatively, they would cut if they see the job market weakening unexpectedly). The next few inflation reports probably won’t show much improvement. Higher gas prices lifted inflation in December and January, and prices of natural gas and eggs rose in January, too, due to the cold snap across much of the country and the bird flu, respectively. Acknowledging that the inflation data are unlikely to justify lower rates near-term, Chair Powell repeated four times in the press conference after the January decision that the Fed should “not be in a hurry” to make further rate cuts.

In addition, the Fed is watching the policy changes that the Trump Administration and new congress are making to see whether higher tariffs, tighter immigration policies, and a new round of fiscal stimulus raise inflation or tighten the job market. Consumers’ are worried about inflation moving up, too. The median expectation for year-ahead inflation in the University of Michigan’s consumer survey rose from 2.7% in October to 3.3% in January, and the expectation for inflation over the next five to ten years rose to 3.2% from 3.0%.

After the Fed decision, Comerica is revising its interest rate forecast to anticipate just a single quarter percentage point rate cut by the Fed this year, down from two cuts prior to the decision. Comerica forecasts for the Fed to hold the Fed funds rate steady through mid-2025, then cut the rate a quarter percent in July as they end the run-off of their Treasury and mortgage-backed security holdings. The federal funds rate is then forecast to hold steady through the first quarter of 2026. The 10-year Treasury yield is forecast to average between 4.25% and 4.75% in 2025 as a steeper yield curve offsets the effect of modestly-lower short term interest rates.

For a PDF version of this publication, click here: Fed Sees No "Hurry" For Further Rate Cuts(PDF, 117 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.