Tariffs and Turbulence Roil the Outlook,

But Economy Can Still Avoid Recession in 2025

The April tariff shock dramatically increased risks to the economic outlook. The first April consumer survey shows economic expectations have plunged to the worst since the early 1980s, on par with Covid, the Great Recession, and the 1990s recession. Financial markets are unsettled. Stocks are in a correction, the dollar is depreciating, and the spread of ten-year Treasury yields above two-year yields is the widest since early 2022. Foreign investors could be starting to factor more political risk into the prices they are willing to pay for U.S. Treasuries.

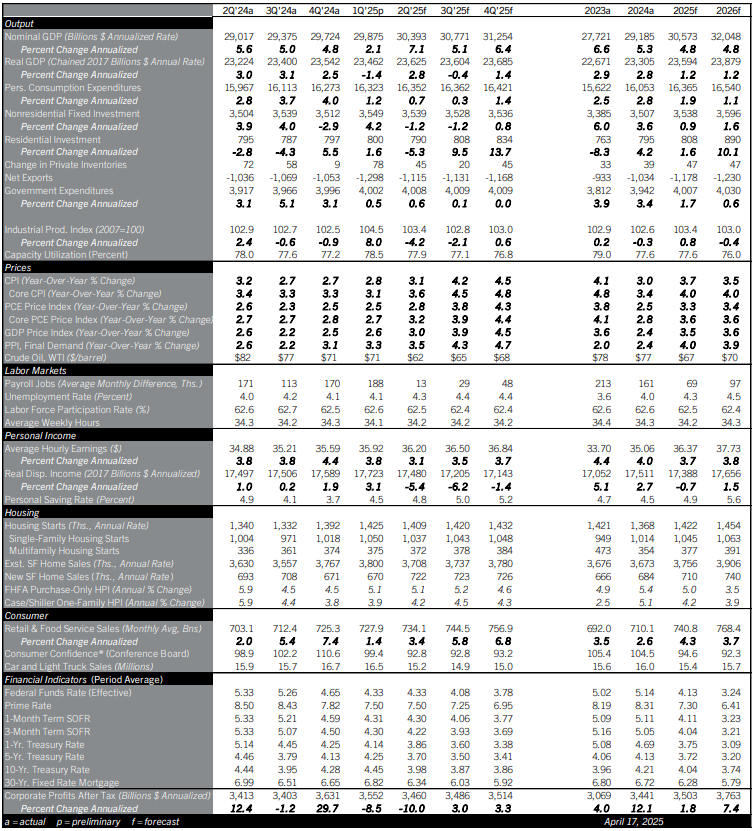

Comerica’s April forecast assumes that the U.S. government enters negotiations with major trading partners that result in partially rolling back tariffs relatively soon. Even so, April’s shock will fuel a growth scare in the second and third quarters of 2025. In response, the Fed is forecast to cut the federal funds target by a quarter percentage point each at the July, September, and December meetings. They are forecast to cut another half percentage point in 2026. Expansionary fiscal policy is assumed to cushion the slowdown next year. Tariff revenues and savings from DOGE are forecast to partially fund an extension of the 2017 tax cuts, as well as a mix of the tax cuts promised during the 2024 presidential election and sweeteners to help the stock market.

Assuming policymakers follow this path, the U.S. economy is seen muddling through 2025 and 2026, but avoiding an outright recession. The unemployment rate is forecast to rise from 4.1% in early 2025 to average 4.5% in 2026, with considerably slower job growth but also weaker labor force growth as immigration enforcement tightens—the administration has announced that over 1.5 million immigrants’ visas were cancelled in March and April. Inflation is forecast to rise, but not to get as bad as in 2022.

Risks to growth are to the downside, and to inflation and interest rates to the upside. Since the tariff hikes, the Fed has been warning that the bar to cut rates is higher with inflation rising than during a conventional economic shock which lowers both demand and prices. The Fed might even have to hike. The trade war could escalate further. Or investors could lose confidence in the U.S. and its currency, causing financial conditions to get worse.

At the same time, more favorable scenarios are not out of the question. Uncertainties from trade and other policy changes could corral the Fed into cutting rates. But once the Fed moves, the administration might announce breakthrough deals with trading partners and roll back tariffs. A pivot toward business-friendly tax and regulatory policies could push trade conflict out of the economic narrative, fueling a recovery of business risk taking, hiring, and consumer spending.

For a PDF version of this publication, click here: April 2025 U.S. Economic Outlook(PDF, 215 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.