Preview of the Week Ahead

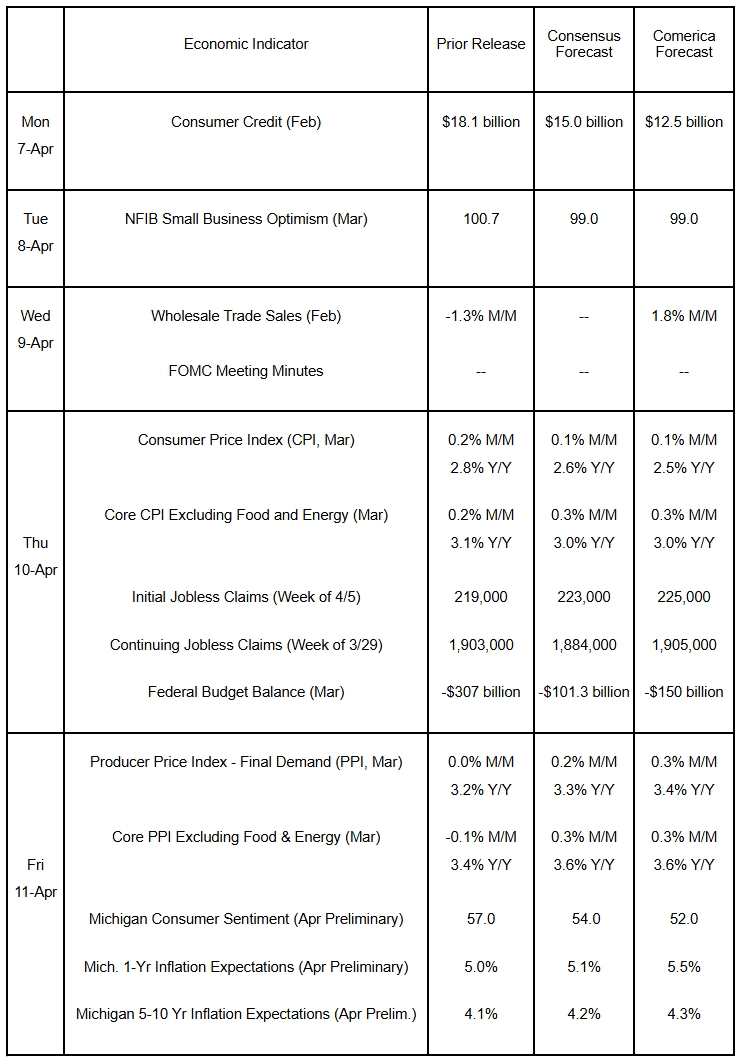

While playing second fiddle to the tariff headlines roiling the stock market, the March FOMC meeting minutes and key inflation readings are the main economic releases this week. Following last week’s announcement of reciprocal tariffs, the minutes are likely dated but might provide clues as to how monetary policymakers will react to a slowing economy with rising inflation. Egg prices were a key driver of inflation in recent months, but fell in March, helping cool inflation at the producer and consumer levels. The University of Michigan’s Survey of Consumer Sentiment will probably show another steep drop in confidence and rise in inflation expectations in the April preliminary release. Small Business Optimism also likely took a leg down. Consumer credit probably rose moderately.

The Week in Review

President Trump imposed sweeping reciprocal tariffs(PDF, 109 KB) ranging from 10% to 50% on April 2nd (Our full analysis is in the linked report). Overshadowed by the tariff announcement, employers added 228,000 jobs in March, well above the 138,000 consensus, but the good news was partially offset by a 48,000 downward revision to the prior two months’ employment figures. Hiring was up in most industries. Employment in the federal government fell modestly, as those on paid leave or receiving severance pay were counted as employed. The unemployment rate edged up to 4.2%. The labor force participation rate ticked higher to 62.5% as more workers entered the labor force. The average workweek held steady at 34.2 hours for the second consecutive month. Average hourly earnings rose by 0.3% from a downwardly revised 0.2% increase in February. Annual wage increases eased to 3.8% in March from the 4.0% increase in the prior month. Job openings fell by 194,000 to 7.568 million in February, with the reduction in vacancies particularly concentrated in private service-providing industries, especially retail. Job postings in all three levels of government were essentially unchanged. The widely-watched number of quits—employee-initiated voluntary separations—and the quits rate were little changed. The jobs data shows the job market was well balanced before the tariff shock, with low unemployment for workers but also better conditions for employers to attract, retain, and develop workers than in recent years.

The manufacturing sector slipped back into contraction in March, according to the ISM Manufacturing PMI survey. The details of the report were ugly: production, employment, and new orders fell; and input costs saw the biggest increase since mid-2022. The ISM Services PMI retreated to 50.8, well below the 54.1 consensus forecast. The report’s details were mixed. Indicators of current and future production diverged, with business activity (current production) up solidly, but new orders down. Employment fell, but prices paid by service providers eased. The surveys show the private sector was treading cautiously in anticipation of the early April tariff announcement.

The trade deficit in goods and services narrowed to $123 billion in February from the $131 billion shortfall in the prior month, but was a stunning 77% higher from a year earlier. The goods deficit narrowed in February, as did the services surplus. The trade imbalance will probably be very large in March as well, as importers continued to front-run tariffs ahead of the hikes made on April 2nd.

For a PDF version of this publication, click here: Comerica Economic Weekly, April 7, 2025(PDF, 140 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.