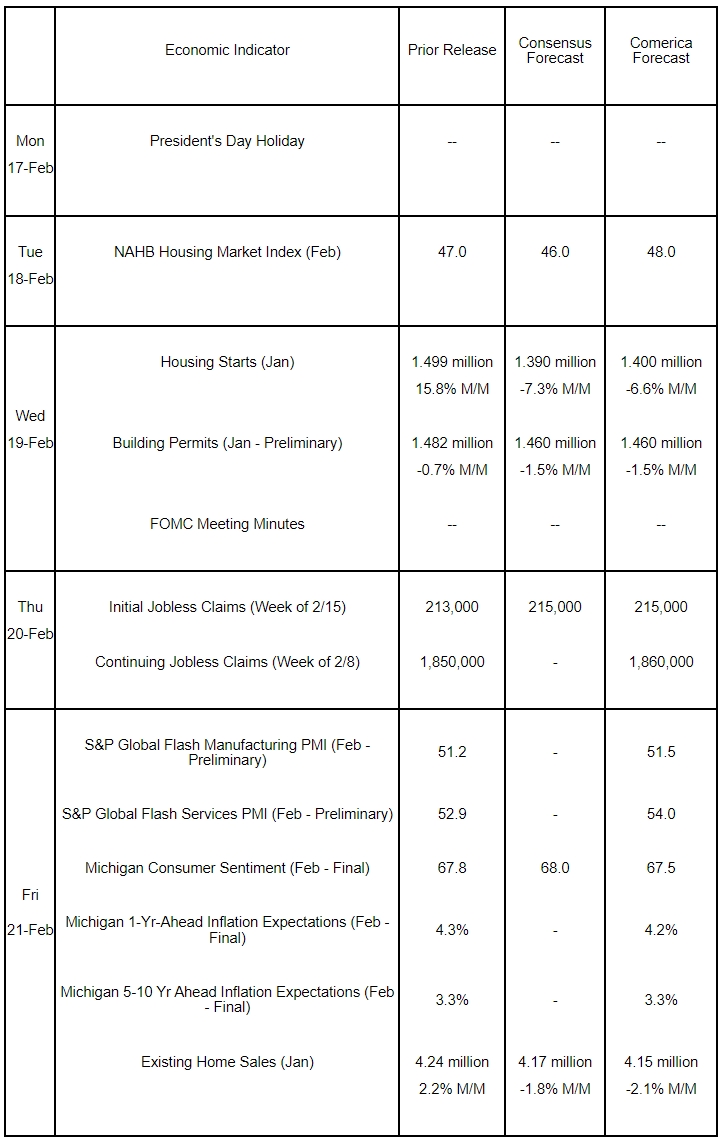

Preview of the Week Ahead

Financial markets will scrutinize the January FOMC meeting minutes to gauge how long the Fed will hold rates steady. Chair Powell repeatedly noted that the FOMC was in ‘no hurry’ to cut rates again at the FOMC’s January press conference and stated it again in testimony to Congress last week. Homebuilding likely retreated in January, with starts hit hard by adverse weather. Weather probably weighed less on permit issuance. A sharp decline in pending home sales in December probably translated into lower existing home sales in January. S&P Global’s February Flash Manufacturing PMI will probably show the sector’s consolidation in expansionary territory, while the Services PMI is anticipated to show service providers’ rebound from the weather-related slump in January.

The Week in Review

Inflation rose faster than expected in January. The Consumer Price Index (CPI) rose 0.5%, edging the annual comparison up a tenth of a percent to 3.0%. Core CPI excluding food and energy was up a sharp 0.4%, resulting in annual inflation also edging up a tenth of a percent to 3.3%. Shelter inflation, up 0.4%, was again the single biggest contributor to the monthly increase, but its effect was markedly lower than in the past couple of years, as several other items pushed inflation higher. Led by a big jump in gasoline prices, energy prices rose 1.1%. Prices of food consumed at home rose 0.5% on soaring egg prices, up 13.8% and 53.0% higher than January 2024. Used car and truck prices rose a sharp 2.2%, a fifth consecutive increase, and were up from a year earlier for the first time in 26 months. Motor vehicle insurance rose 2.0%. Also led by big increases in energy and food prices, the Producer Price Index (PPI) rose by 0.4% in January from an upwardly-revised 0.5% increase in the prior month. In annual terms, PPI held steady at 3.5% for a second month, but has accelerated from its recent low of 2.1% recorded in September. PPI excluding food and energy rose by 0.3% on the month and was up 3.6% from a year earlier. Higher energy costs spilled over into the services sector as well, with transportation and warehousing service prices up sharply. Traveler accommodation service prices soared by nearly 6%.

The federal government posted a shortfall of $129 billion in January, sending the deficit in the first four months of the current fiscal year to $840 billion, a stunning 58% deterioration compared to the same period in the prior fiscal year. Lackluster growth in revenues, up 0.7%, and significantly higher expenditures, up 15.1%, are both contributing to the burgeoning deficit. On the revenue side, personal income tax receipts are up a modest 1.9%, while corporate income tax receipts are down 21.0%. The five largest expenditure items are up significantly fiscal year-to-date: Social Security, up 7%; Medicare, up 47%; defense, up 12%; net interest, up 14%; and health (mostly Medicaid), up 10%.

Affected by bad weather, the wildfires, and a severe flu season, retail sales plunged by 0.9% in January, much worse than the consensus expectation for no change. The decline was broad-based, with nine of the thirteen retail subsectors down last month. Core retail sales also plummeted by a hefty 0.8%. Industrial production rose by 0.5% in January and was, unsurprisingly, driven solely by a steep 7.2% increase in utilities production. Manufacturing slid by 0.1%, while mining output tumbled by 1.2%.

For a PDF version of this publication, click here: Comerica Economic Weekly, February 17, 2025(PDF, 144 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.