Preview of the Week Ahead

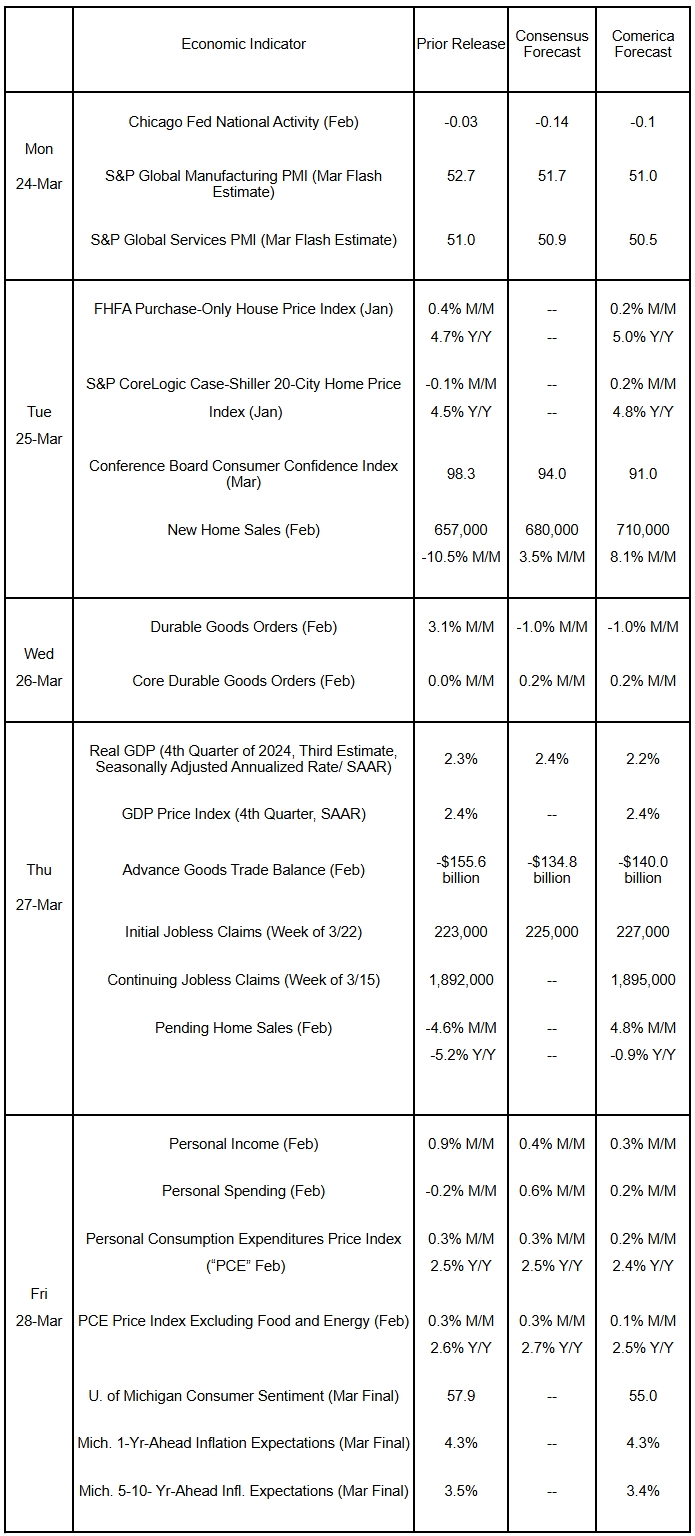

Economic growth could be revised lower in the third estimate of GDP for the fourth quarter of last year, with services spending likely to be marked down. Household incomes and spending likely rose modestly in February, while inflation, as measured by the PCE indices, probably moderated. S&P Global’s initial business survey for March will probably show a further easing in economic activity. Front-running tariffs likely held the goods trade balance near January’s record low in February. House prices are expected to have grown at a slower pace in January, keeping annual increases in the mid-single digits. Consumer confidence surveys are anticipated to show further declines in March.

The Week in Review

The Federal Open Market Committee (FOMC) unanimously held the fed funds target steady at a range of 4.25% to 4.50%, and voted 11-1 to slow the pace of the reduction of the Fed’s Treasury holdings from $25 billion a month at present to $5 billion a month starting April 1st. Governor Waller was the lone dissenter, voting instead to continue reducing Treasury holdings at the current pace. In their latest forecast, the median policymaker revised down their annual 2025 fourth quarter economic growth projection to 1.7% from 2.1% in December, when they last published projections. The unemployment forecast was raised to 4.4% by year end. They also raised the forecast for PCE inflation in the fourth quarter of 2025 to 2.7% from 2.5% previously, while core inflation’s forecast was raised to 2.8%. Chair Powell dusted off the infamous word “transitory” to describe the Fed’s forecast for higher inflation this year, with policymakers still forecasting (hoping?) that inflation can cool in 2026. The median policymaker continues to see half a percent of cumulative rate cuts as appropriate in 2025, but four thought it would be appropriate to hold rates unchanged; in December just one thought that was best.

Consumer spending was tepid in February. Matching Comerica Economics’ forecast, sales at retail establishments, food services and drinking places rose by a modest 0.2% in February from a downwardly revised 1.2% drop in January and undershot the consensus forecast for a 0.8% rebound. February’s disappointment was broad-based, with sales down in seven of the 13 retail subcategories and flat in one more. Core retail sales, used in the computation of nominal consumer spending on most goods in the GDP report, rose by 1.0% in February, reversing an equal decline in January.

The NAHB / Wells Fargo Housing Market Index fell to a 7-month low of 39 in March. Homebuilders’ assessments of current conditions eased again, as buyer foot traffic slowed. Sales expectations six months ahead stabilized, likely due to the postponement of tariffs on Canadian lumber, which are scheduled to go into effect April 2. Homebuilders estimate that higher tariffs would raise construction costs by $9,200 per home. Building permits fell by 1.2% and were down for a third consecutive month, while starts rebounded 11.2%, almost erasing January’s fall. Existing home sales rose 4.2% to an annualized rate of 4.26 million in February and were much better than the 3.9 million consensus prediction. Inventories rose to 1.240 million units and were up nearly 200,000 from a year earlier. The median price of an existing home at $398,400 was up nearly $15,000 from a year earlier.

For a PDF version of this publication, click here: Comerica Economic Weekly, March 24, 2025(PDF, 205 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.