Payrolls Rose Solidly in February, But the Unemployment Rate Was Higher, Too;

Supply and Demand Are Heading Back to Normal in the Job Market

• The February jobs report was mostly cooler than expected.

• Employment fell in the survey of households and the unemployment rate rose to the highest since early 2022.

• While employment rose solidly in the survey of employers, there were offsetting downward revisions to the previous two months’ job growth.

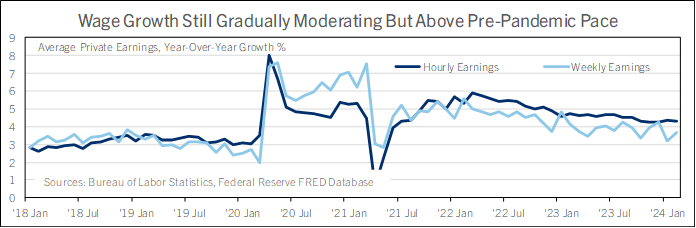

• Wage growth cooled after running hot in January.

• The mostly-cool jobs report increases the likelihood that the Fed begins cutting interest rates in the second quarter.

• Even so, the Fed is likely to slow-roll rate cuts in 2024 to rebuild credibility after inflation overshot their target in recent years.

The February jobs report was messy, with conflicting signals coming from its two constituent surveys.

In the survey of households, employment fell 184,000 with the labor force up 150,000 on the month. That led to a 334,000 increase in unemployment, pushing the unemployment rate up to 3.9% from 3.7% in January. February saw the highest unemployment rate since January 2022. The unemployment rate for women over 20 rose to 3.5% from 3.2%, for men over 20 edged down to 3.5% from 3.6%, and for teenagers of both sexes rose to 12.5% from 10.6%. The unemployment rate for White Americans held steady at 3.4%, for Black or African Americans rose to 5.6% from 5.3%, and for Asian Americans rose to 3.4% from 2.9%. The unemployment rate for Hispanic or Latino Americans held steady at 5.0%. The unemployment rate for people with a disability (not adjusted for seasonal variations) rose to 7.7% from 6.6% in January and was up from 7.3% a year earlier.

The labor force participation rate was flat on the month at 62.5%, down from over 63% prior to the pandemic. The main reason it hasn’t recovered to its pre-pandemic level is that a smaller share of older Americans are working. The labor force participation rate for workers between 25 and 54 years old rose to 83.5% in February, tying for the highest since 2002; labor force participation for workers 16-24 has been similar to pre-pandemic levels in recent months.

Trends were somewhat stronger in the survey of employers, which saw nonfarm employment rise 275,000 on the month. However, job growth in December and January was revised down by 167,000, so the net increase in employment since last month was less than half the headline. Even so, payrolls have risen 265,000 per month in the last three months, a very respectable pace. In February, private businesses added 223,000 jobs, with 19,000 in goods-producing industries and 204,000 in private service-providing industries. Healthcare and social assistance jobs rose 91,000, leisure and hospitality rose 58,000, transportation and warehousing rose 20,000, and retail added 19,000. Government added 52,000, mostly at the local government level.

The average workweek edged up to 34.3 hours from 34.2 in January, when bad weather held it down. February saw a longer workweek in mining, logging, and construction, where lots of jobs are worked outdoors, and in retail, leisure and hospitality, where an outsize share of workers are hourly.

Average hourly earnings rose modestly in February, which was largely giveback after weather reduced hours worked by lower-paid hourly employees in January. Average hourly earnings rose 0.1% after January’s downwardly-revised 0.5% jump (0.6% previously). From a year earlier, average hourly earnings growth slowed to 4.3% from 4.5% in January. The trend of wage growth in the monthly jobs report is cooling, like other measures of labor costs, like ADP’s median wage indexes, the quarterly employment cost index, and business surveys.

The Fed will see the February jobs report as a sign they are succeeding in cooling the economy. Other recent labor market data, like the cool hires and quits numbers in the Job Openings and Labor Turnover Survey released earlier in March, agree with the unemployment rate that the job market is returning to a more normal balance between demand and supply after running very hot between late 2021 and early 2023.

To be clear, the February jobs report doesn’t look recessionary. But it does suggest the Fed is getting closer to calming the dynamics that contributed to high inflation in 2022 and 2023. That adds to confidence that the Fed will pivot to rate cuts in the second quarter of 2024. Comerica forecasts for the Fed to cut the federal funds target a quarter percentage point at its June, September, and December decisions this year, slightly less than the four cumulative rate cuts priced in by financial markets after the jobs report’s release.

Comerica’s forecast is based on simple logic. Most recent data suggest that inflation is coming back under control as the labor market cools, so lowering interest rates faster than Comerica’s forecast (which matches the Fed’s latest projections released in December) would be more likely to maintain a strong job market as inflation cools. But the Fed’s not just trying to balance their inflation and employment mandates. They are also trying to rebuild credibility after badly missing the inflation target between late 2021 and the first half of 2023.

As a result, they are more inclined to risk keeping rates high for longer than might be necessary, even if that means raising the unemployment rate more than necessary. They’d prefer that to cutting rates too early and allowing inflation to rebound, which would confirm the suspicions of observers who have questioned the Fed’s commitment to low inflation over the last few years.