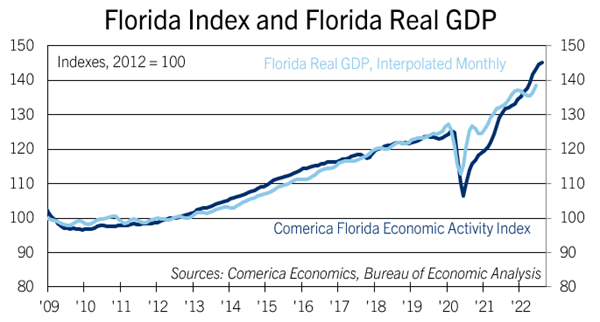

Florida Index Jumps Again in August

The Comerica Florida Economic Activity Index rose at a 10.3% annualized rate in the three months through August. The Index has posted double-digit gains in seven of the last eight months. The index was up 10.2% in August compared to a year earlier. While the August data doesn’t capture the devastation inflicted by Hurricane Ian, it does demonstrate the state’s strong economic momentum prior to the disaster, which will help propel the state’s recovery from it.

Four of the index’s nine components improved in August. The labor market is exceptionally strong in Florida, with the state’s unemployment rate of 2.7% in August a full percentage point below the national average of 3.7%. Employment rose for the 28th consecutive month during the month.

Housing starts in Florida rose sharply in August, but house prices declined for the first time in over five years. After prices rose much faster than incomes between the onset of the pandemic and early 2022, and then mortgage interest rates surged this year, housing activity is likely to pull back substantially over the next few quarters. Even so, Florida’s strong fundamentals mean that the state’s housing correction is likely to be milder than the rest of the nation’s. Furthermore, seasonally-adjusted hotel occupancy data showed tourism in the state continued to pick up in August, bucking a slowdown in consumer spending elsewhere in the nation.

Looking forward to 2023, Florida’s strong labor market and population growth will help the Sunshine State weather a cooler national economy. Economic data from September and October will reflect a huge blow from Hurricane Ian. After that, Florida will likely resume growth, but at a slower pace than earlier in 2022, due to headwinds from high inflation, rapidly rising interest rates, and spillovers from a weaker national and global economy.